At school we have not learned how to invest successfully. We have not learned how to make the transactions in our lives with a positive result more than those with a negative one, how to protect ourselves so that we do not lose everything we have and even what we have borrowed.

So where can we learn about best practices and what do people who increase their capital through real estate transactions do?

- A) Books – there are books mainly from the United States that reflect the specifics of the market there. There is more of „what needs to be done“ in the books, but very little of „how it needs to be done.“

- B) Consultant, real estate agent who has experience and capacity – everyone says they have experience and know everything. So in order to be able to assess who your agent is and who to trust, you still need to know this and that.

- C) An investor who does it – if you know someone who regularly buys, develops, sells, rents out real estate… someone who is OK with sharing all the details of the transactions he/she makes, you will surely learn a lot.

The agents in our team work with investors of different calibers. One thing the investors have in common is – they all work with agents, because they know that the information is valuable and it is the basis for a successful real estate investment. That one thing is in common, but the differences are many:

- where are the money come from – they are own, from other people or from a bank

- what types of real estate they invest in – plots, apartments (new or old for renovation), offices, houses, garages, renting, etc.

- volumes – from one transaction for several years to dozens of transactions for a year.

- Investors who build buildings to sell or rent out.

Our team has worked and continues to work with all the listed types. From people who make one or more transactions in their lives, to advising investors who make transactions for millions a year.

So we haven’t gotten to the point of writing a book yet but we’ve managed to create a „Guide to Successful Real Estate Investments.“ This is a handbook in which we have synthesized the most important things you need to know from a practical point of view to understand more of what real estate investors do and to be able to:

- filter the information correctly

- estimate who is telling you the truth and who is lying

- estimate who is a good agent and who just pretends to be one

- make the right decisions

- make a winning strategy

What will you learn from this guide about the real estate investor?

- How to make from 35% to 100% profit?

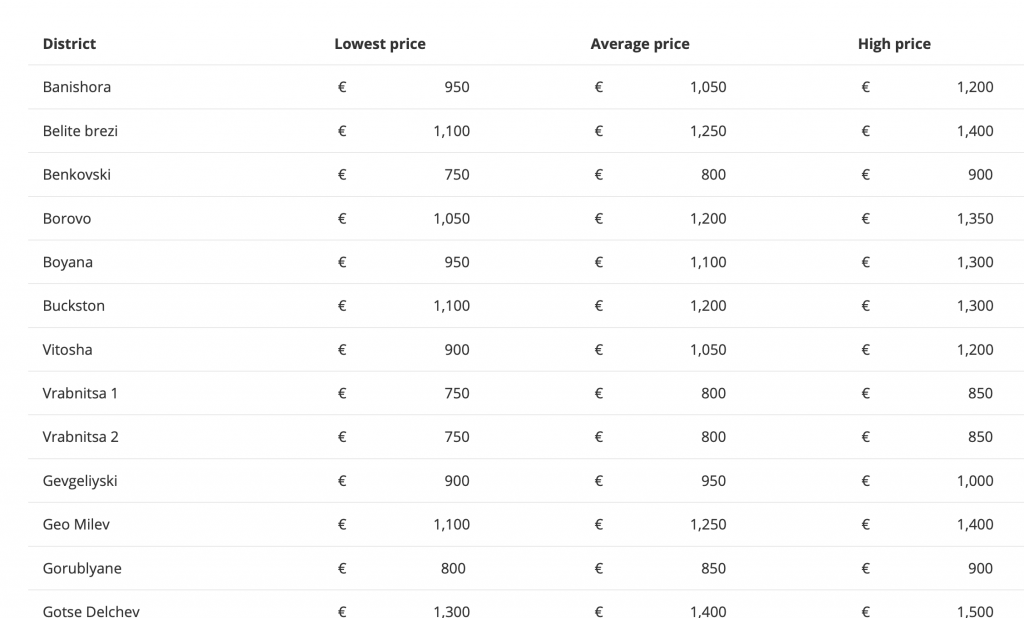

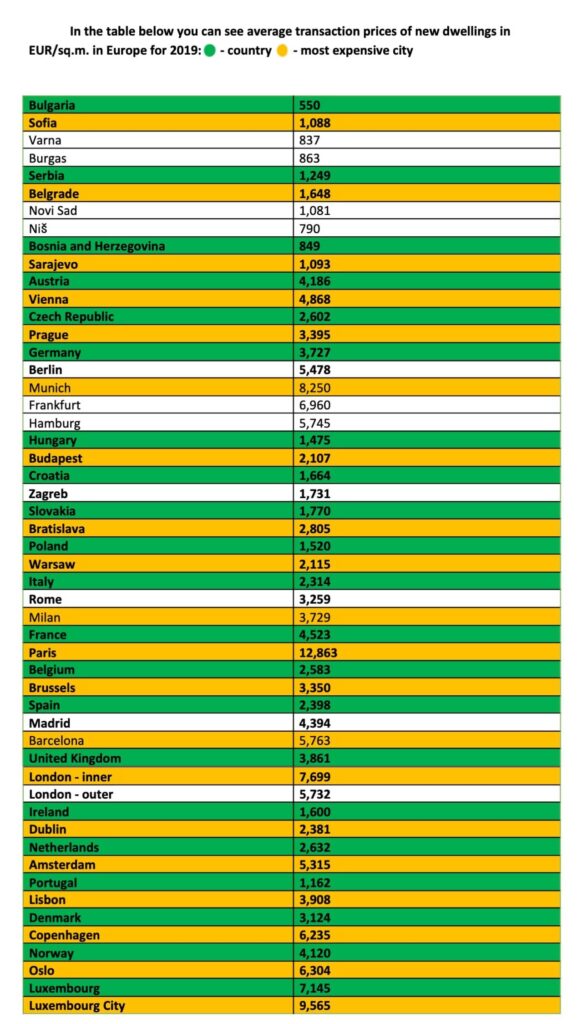

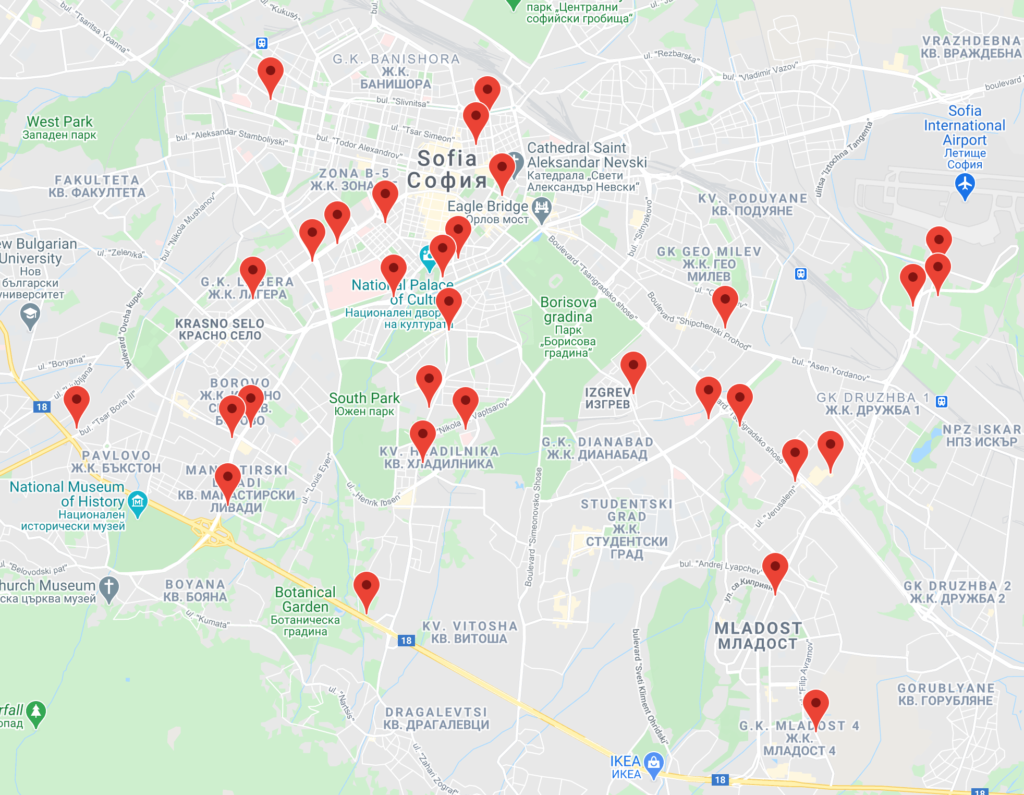

- What are the most promising districts for investment?

- What are the most suitable properties for investment?

- How is the return on investment calculated and forecast?

- Investment or own home?

- How to get the best price when buying, what is a group investment?

- How to buy real estate for sale without having all the necessary funds?

- How to approach the transaction strategically?

- How to negotiate and achieve a good price when buying or selling?

- How to make a transaction during a crisis?

- How to sell real estate at the best price?

We wish you more informed decisions, a positive balance and peaceful evenings.

If you want to understand the Bulgarian property market,

Download this free Real Estate Investment Guide created by local experts.

[grwebform url=“https://app.getresponse.com/view_webform_v2.js?u=Bhrp5&webforms_id=25336103″ css=“on“ center=“off“ center_margin=“200″/]

Disclaimer: Delta Analysis Foundation is a registered non-profit legal entity for carrying out public benefit activities. The materials published on the platform are for informational, educational and research purposes only in order to support the mission of the foundation and should not be perceived as specialized advice on real estate transactions. Delta Analytics Foundation is not responsible for the way you use the information contained on the site. Always turn to qualified professionals for financial, legal and other matters according to your specific circumstances and take action based on your informed choice.