2020 г. донесе много притеснения на пазара на недвижимите имоти навсякъде по света. Цените на имотите в София са чувствително по-ниски спрямо други градове и столици в Европа. Често хората си мислят, че цените в София са високи… в сравнение с какво обаче? Като столица на държава от Европейския Съюз с цени сравними с тези в Скопие например и чувстивтелно по-ниски от тези в Белград (изън ЕС), то София се превръща в едно перспективно място за живеене и инвестиция. В средносрочен и дългосрочен план, цените на имотите в София ще се покачват и имотите ще станат още по-скъпи и по-недостъпни, както това вече се е случило във всички столици на развитите и развиващите се дръжави по света.

Светът става все по-глобален и тепърва ще наблюдаваме миграция на чужденци към нашата родна столица, както и завръщащи се българи, просто защото условията за живот са добри, има търсене за хора с умения на пзара на труда, а цените на имотите и цената на живот като цяло са най-изгодни в ЕС.

Преди да се появи пандемията, прогнозите за развитието на недвижимите имоти в цял свят през 2020 г. бяха обещаващи. Въпреки това продължаващата пандемия създаде безпрецедентна несигурност в почти всяка икономика по света. Следователно, изглежда някак естествено да се появи следният въпрос:

Какво се очаква да стане с цените на имотите в София в близкото бъдеще?

Пандемията е в разгари си и вилнее вече година (януари 2021) и все пак цените на имотите не се „сринаха“, както много хора очакваха. Намаля прозиводството на нови жилищни единици, тъй като някои инвеститори изчакват по-стабилен и предвидим период. Но същевременно много хора със спестявания се насочиха към имотите като начин да се защитят от рисковете на високата инфлация, поради голямото „печатане“ на трилиони долари и евро, с цел подпомагане на иконимикие по света. И така цените се задържаха, някъде покачиха, а вече края на пандемията се вижда и оптимизмът ще се завърне. Всичко това е предпоставка да очакваме нова ера за пазара на имоти в София и тази нова ера не включва падане, сриване, спукване и всякакви подобни епитети.

Въпреки общата песимистична прогноза за икономическите последици след коронавирус пандемията, от гледна точка на пазара на недвижими имоти тази криза се различава от предходната през 2008. Коронавирус кризата се очаква да навреди много по-малко на пазара на недвижимите имоти в сравнение с кризата през 2008.

Ако се абстрахираме от пандемията, много често се коментира как цените в София са прекалено високи и как за определена сума човек вместо да си закупи апартамент в София може да си закупи къща в Германия, Англия, Италия и т.н. Но дали това е реалността или резултат на непълна, или неточна информация? В тази статия ще Ви покажем как реално се случват нещата и ще сравним цените на жилищните имоти в цяла Европа.

Що се отнася до развитието на цените на жилищните имоти, мнозина биха спорили, че апартаментите в София са твърде скъпи и в някои случаи могат да бъдат дори по-скъпи от къща в Германия, Англия, Франция или друга развита европейска страна. Да, в някои случаи това е вярно, но всичко зависи от локацията, околната среда, вида имот и множество други фактори. За да говорим за цените на имотите, трябва да погледнем нещата обективно – т.е. да сравним столица със столица, голям град с голям град, село със село.

Неутрално погледнато, София е европейска столица, поради което трябва да бъде сравнявана с друга европейска столица, за да се направи паралел между цените на имотите. Да, има своите немалки недостатъци, но това е най-големият и развит град в България и в някои отношения по нищо не отстъпва на други европейски столици. Следователно, по никакъв начин не е правилно цените на имотите в една европейска столица да се сравняват с тези в някое село, било то в най-развитата европейска страна и да се изтъкват неправилни аргументи от сорта на, „Аз в Германия ще си купя къща за 80 000 €, а пък тристаен апартамент в София е 100 000 €“. Има места в България, където можете да си закупите къща и за € 5 000.

Каква обаче би била цената на имотите в Берлин, Милано, Барселона и в други големи градове и столици в Европа сравнени с тези в София?

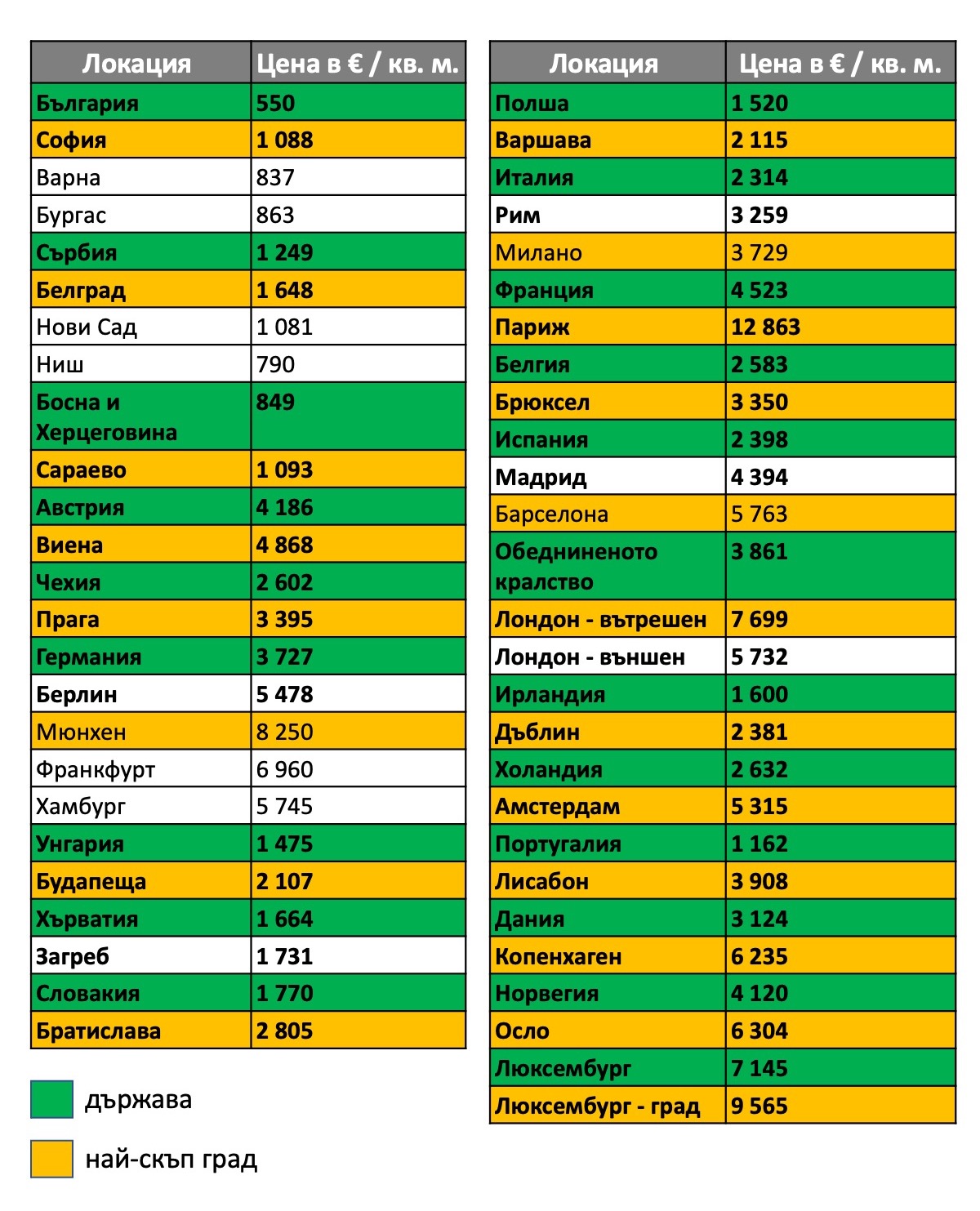

В таблицата можете да разгледате средни цени в евро/кв.м. за покупка на ново жилищно строителство в София и Европа за 2019 г.

В сравнение с други европейски столици, София е с най-ниските цени за ново жилищно строителство в Европа, дори след Белград и то с около 60%. Въпреки това някой би казал, че вероятно сърбите са с по-високи доходи от тези на българите. Нека тогава ги сравним:

| Сърбия | България | ||

| БВП (ППС, 2020) | $ 137,126 млрд.

(на 75-о място) |

БВП (ППС, 2020) | $ 164 млрд.

(на 74-о място) |

| БВП на човек (ППС) | $ 19 767

(на 67-о място) |

БВП на човек (ППС) | $ 23 741

(на 60-о място) |

| БВП (ном., 2020) | $ 55,437 млрд.

(на 81-о място) |

БВП (ном., 2020) | $ 67 млрд.

(на 72-ро място) |

| БВП на човек (ном.) | $7 992

(на 76-о място) |

БВП на човек (ном.) | $ 9 826

(на 68-о място) |

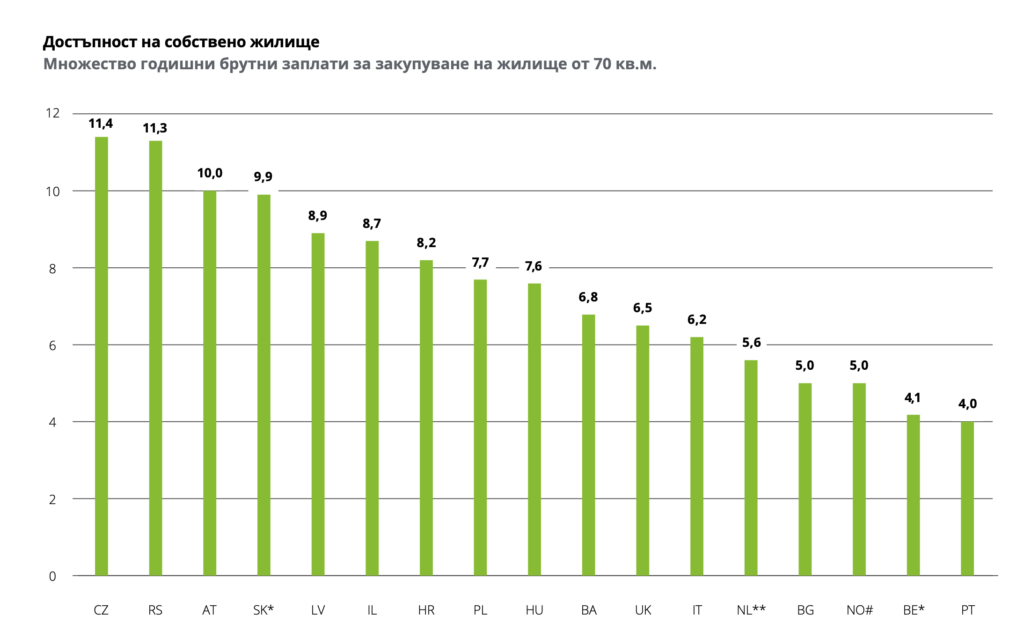

Ако се абстрахираме от София и Белград, се оказва, че България е една от страните, в които е най-лесно човек да притежава собствено жилище от около 70 кв.м. Според средната заплата за Сърбия и България, да притежаваме жилище от 70 кв.м. в България е почти 2 пъти по-лесно, отколкото в Сърбия. Една идея по-лесно е в Португалия, Белгия и Норвегия, а най-трудно се оказва, че е в Чехия, Австрия и Словакия.

Друг основен фактор, който е много важно да се спомене, са лихвените проценти по ипотечните кредити. През 2019 г. средният лихвен процент по ипотечните кредити в България е бил 2,9%, което ни измества малко след средното за Европа и ни нарежда между Норвегия с 2,8% и Хърватия с 3%. Най-добри условия може да получите в Португалия – 1,1%, а най-лоши се оказват в Унгария – 4,6%.

Според статистиката София отчита най-ниски цени на наемите на жилища в Европа. С цена от 4,1 €/кв.м. ние се нареждаме до Сараево. Класацията за най-високи наеми се води от Люксембург с 30 €/кв.м., следван от Париж с 28,3 €/кв.м. и Осло с 25,8 €/кв.м.

За да се оцени достъпността на собствените жилища, е нужно да се изчисли броят средни брутни годишни заплати, нужни за закупуването на стандартизирано ново жилище. В това отношение България беше една от държавите със сравнително достъпни собствени жилища (5 пъти средната брутна годишна заплата).

Нещо повече, България отчита относително голям жилищен фонд на 1 000 граждани (566,2 жилища на 1 000 граждани), което показва, че интензивността на развитие, както по отношение на започнатите, така и на завършените жилища е на добро ниво.

Нещо повече, България отчита относително голям жилищен фонд на 1 000 граждани (566,2 жилища на 1 000 граждани), което показва, че интензивността на развитие, както по отношение на започнатите, така и на завършените жилища е на добро ниво.

Ако в момента цените в София Ви се струват прекалено високи, то няма данни, сочещи, че те ще падат в дългосрочна перспектива. През следващите няколко години се очаква запазване или спад на лихвите по кредитите, което най-малкото ще запази леката тенденция на покачване на цените.

В случай, че имате желание да закупите имот в София и сте решили, че трябва да изчакате някоя или друга година, за да паднат цените, ще Ви разочароваме, защото в дългосрочен план това не се очаква. Винаги има вероятност за моментни спадове в определени ситуации, но реално погледнато, София се развива освен инфраструктурно и в много други направления, затова е напълно нормално да се превръща в по-скъп и по-скъп град.

За целта на този анализ използвахме данни от нашия опит, от НСИ, както и от международния доклад на Deloitte – Property Index, където за първи път е включена България.

Тук може да видите предстоящ жилищен комплекс до метростанция с цени от 780€ за кв. м.

ЕТИКЕТИ: цените на имотите в София, цени на жилищата в София, ще паднат ли цените на имотите, ще има ли спад в цените на имотите.

ЕТИКЕТИ: цените на имотите в София, цени на жилищата в София, ще паднат ли цените на имотите, ще има ли спад в цените на имотите.

Предупреждение. Фондация “Делта Анализи” е регистрирано юридическо лице с нестопанска цел за осъществяване на общественополезна дейност. Материалите, публикувани в платформата, са само с информационно-образователен и проучвателен характер с цел да подпомогнат мисията на фондацията и не бива да се възприемат като специализирана консултация по сделки с недвижими имоти. Фондация “Делта Анализи” не носи отговорност за начина, по който използвате информацията, съдържаща се в сайта. Винаги се обръщайте към квалифицирани специалисти за въпроси от финансов, правен и друг характер според вашите специфични обстоятелства и предприемете действие на базата на вашия информиран избор.