Източници:

Giles, Chris, and Valentina Romei. “Pandemic Fuels Broadest Global House Price Boom in Two Decades.” Financial Times, Financial Times, 1 Aug. 2021, on.ft.com/3C6QmCX.

Цените на имотите растат бързо в почти всяка развита икономика в света по време на пандемията, оформяйки най-мащабното рали за последните две десетилетия и подбуждайки притеснения относно финансовата стабилност.

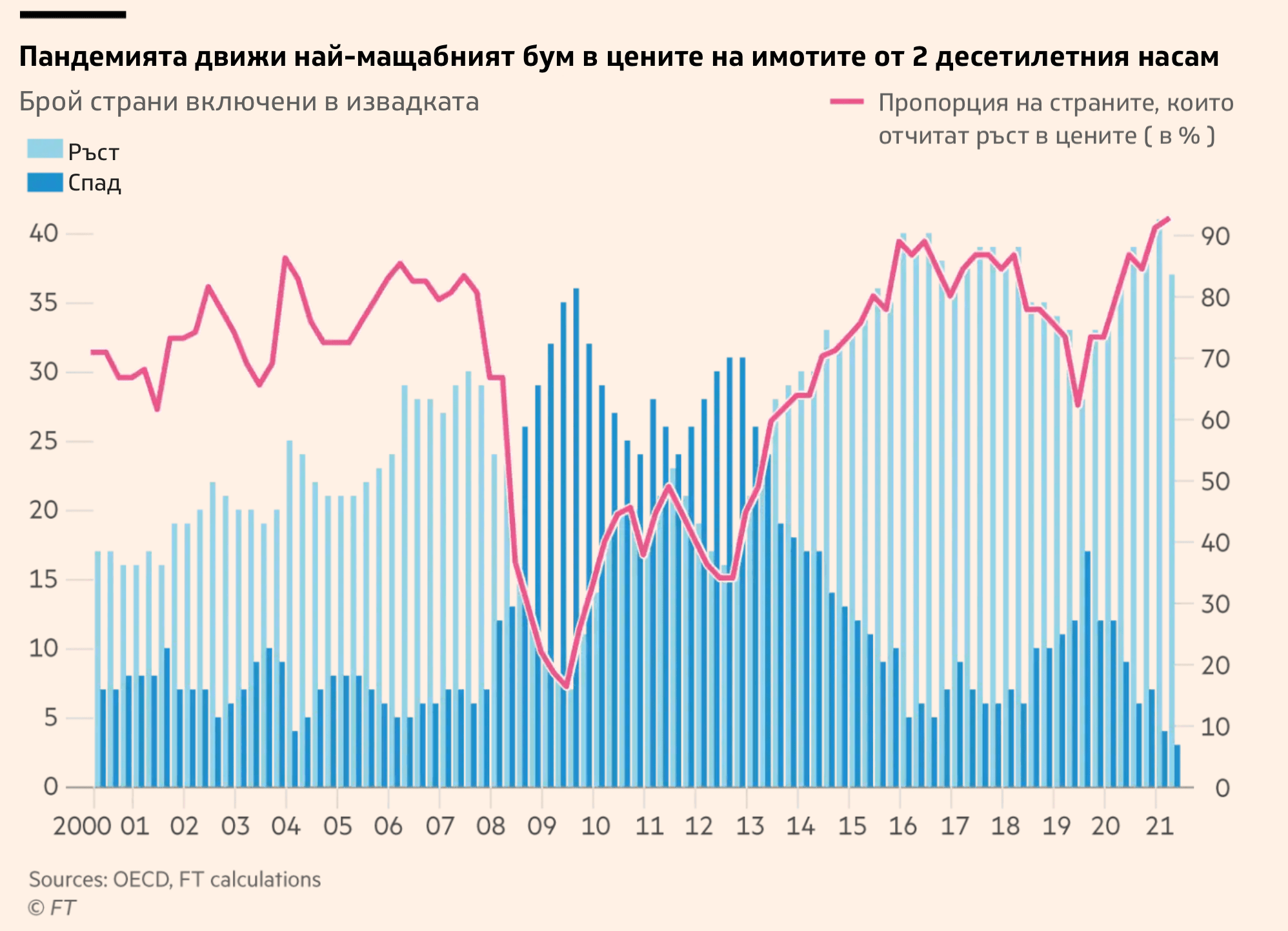

От общо 40 страни включени в ОИСР (Организацията за икономическо сътрудничество и развитие) само в 3 е отчетен спад на цените на имотите в първите 3 месеца на тази година – журналистите от Financial Times откриват, че това е най-малката пропорция (3 от 40 страни със спад в цените на имотите) от 2000 г. насам, откакто се събират данни.

Кои са факторите, които захранват стабилно ръста в цените на имотите:

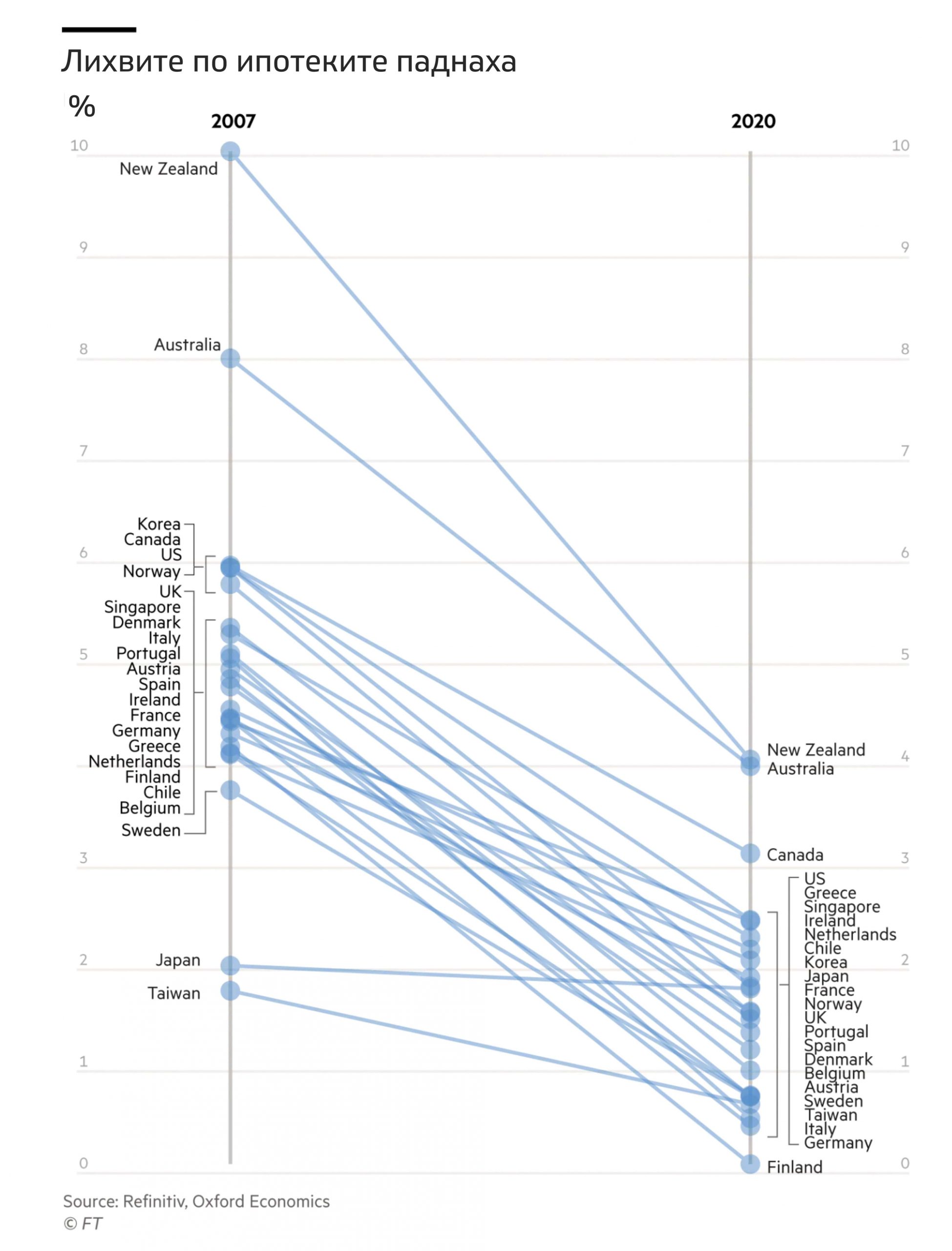

- Исторически най-ниските лихви по ипотеките

- Ръстът в спестяванията на домакинствата по време на пандемията

- Желанието за повече място след като офиса се премести у дома

- Фискални и монетарни стимули от ФЕД и ЕЦБ („печатането“ и пускането в обръщение на огромни суми пари)

- Страхът от набиращата скорост инфлация и обезценяване на парите

Повишаването на цените на имотите може е добре за икономиката в краткосрочен план, защото собствениците на имоти се чувстват по-богати и могат да харчат повече заради по-високите оценки на техните активи.

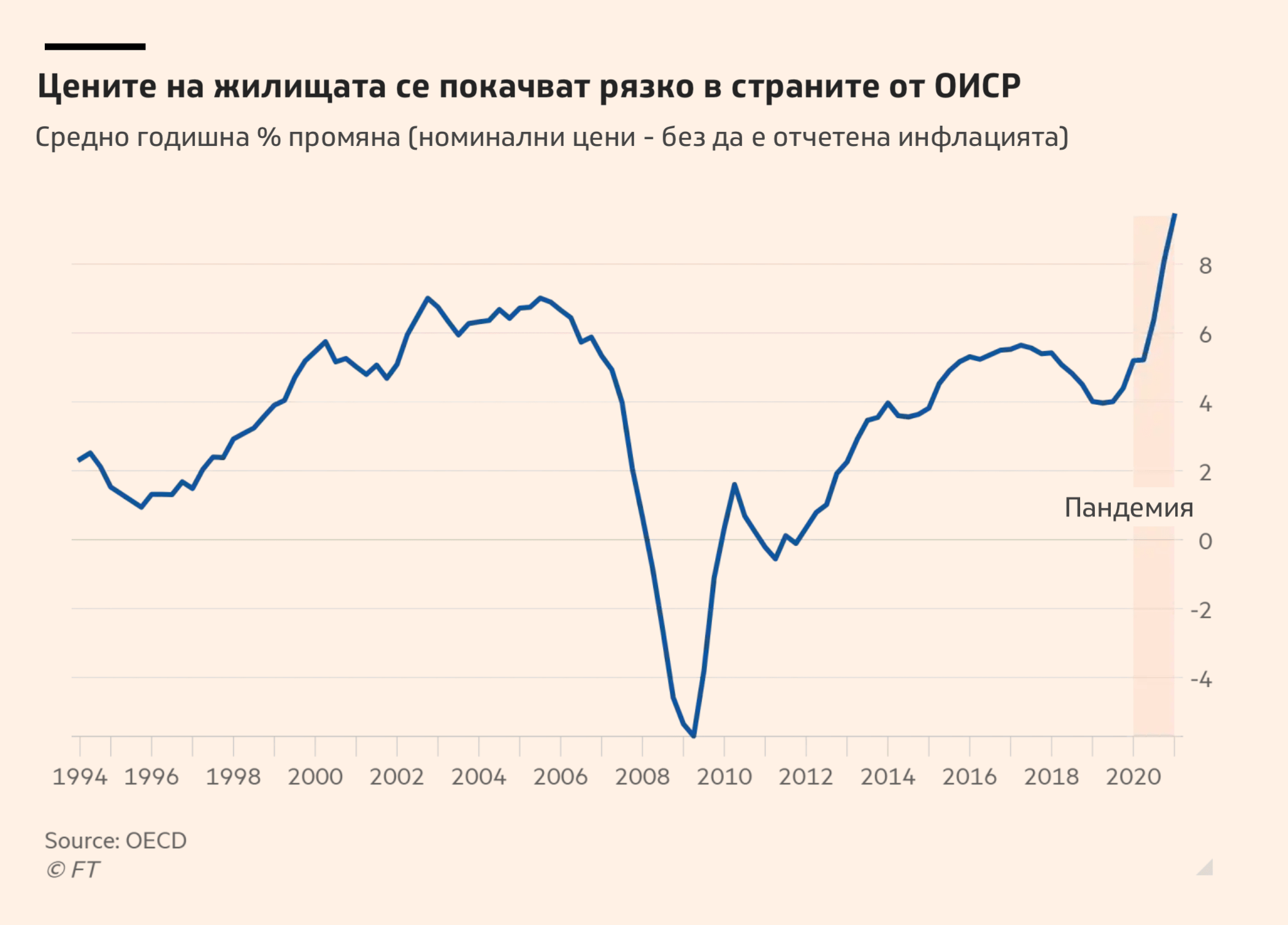

Средно годишно покачване на цените в ОИСР

Средното годишно покачване на цените на жилищата в първото тримесечие на 2021 г., след като икономиките на „богатите нации“ (ОИСР) се възстановиха от вирусната рецесия през 2020 г. е 9.4% – най-бързото покачване в последните 30 години.

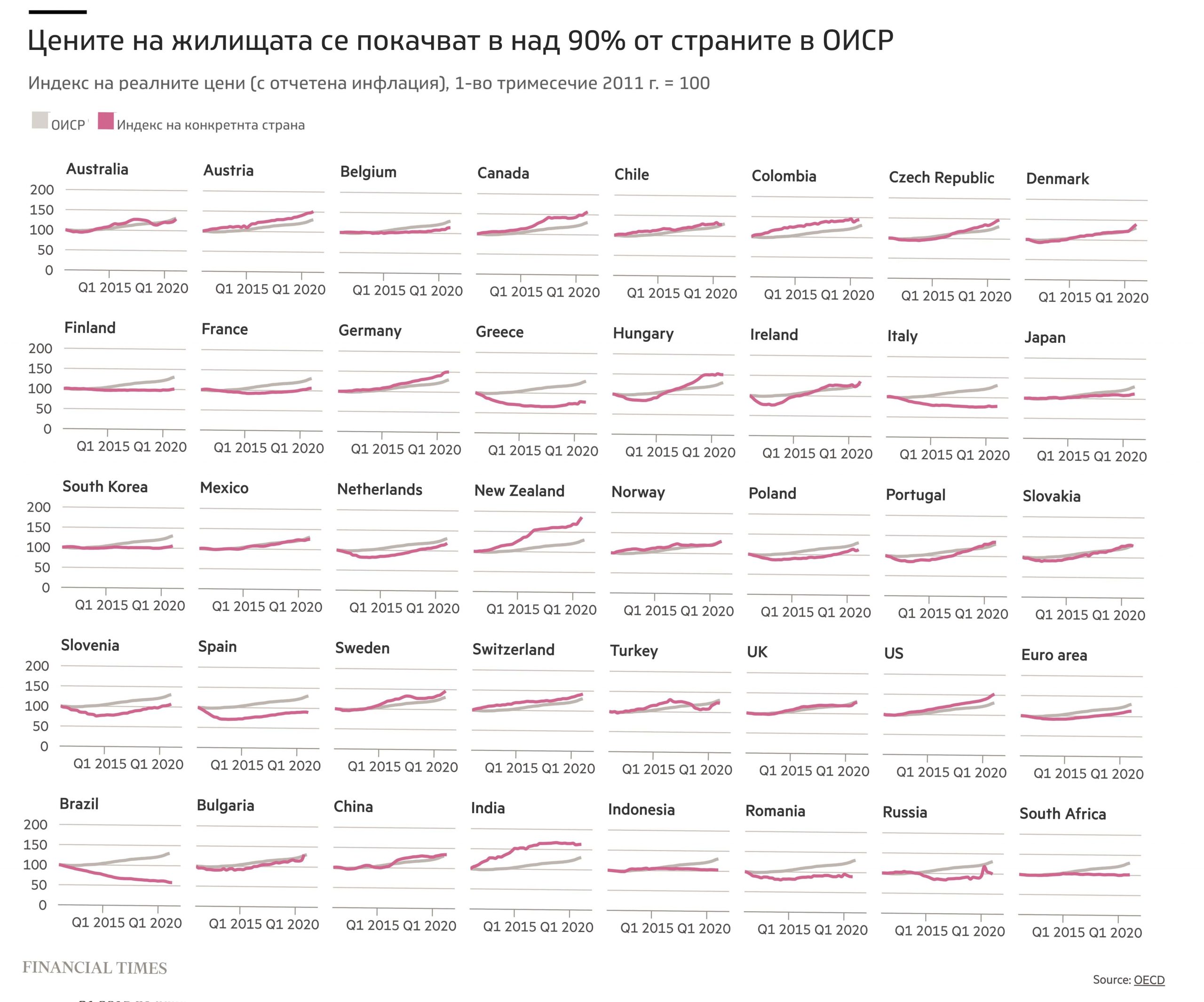

Графиката показва, че цените на жилищата растат навсякъде в северното полукълбо.

Най-бързо цените се покачват в САЩ, Канада, Нова Зеландия, Южна Кореа, Дания, Чехия, Великобритания и Турция. Интересен факт е че инфлацията в Турция е висока (+ 17.5% на годишна база отчетена през юни 2021 г.) и Ердоган е ограничил износа на пари извън страната, което води до търсене на сигурност в имоти.

Интересно е да се отбележи, че в трите страни с най-силно развит туризъм в ЕС – Гърция, Италия и Испания – цените на имотите все още не са се върнали на нивото от 2011 г. и сериозно изостават от средните стойности на страните в ОИСР.

Най-сериозен спад в цените се отбелязва в Бразилия, като те са паднали с близо 50% от нивото им през 2011 г.

Защо всъщност се покачват цените на имотите?

Икономическите условия за растежа в цените на имотите са екстремно добри от гледна точка на ипотечното кредитиране с рекордно ниските нива на лихвите в период на ниска икономическа активност, според Клаудио Борио (Ръководител на монетарния отдел в банката за централните банки – Bank of international Settlements).

Ниският разход на заемите правят покупката на имот много по-привлекателна, от колкото наема или други инвестиционни алтернативи.

В допълнение, много домакинства (в частност тези със средни и високи доходи) успяха да акумулират големи спестявания от старта на пандемията, като локдауните лимитираха харченето, докато много професии не бяха засегнати. Примерно в България, ръста на депозитите е 13.52% към юни 2021 г. в сравнение с началото на извънредното положение през март 2020 г., според данни на БНБ.

Новината, че една от най-големите банки в България вече няма да предлага депозита като банков продукт, както новата „такса влог“ от 0.7% на годишна база за влоговете над 400 лв., говори за това, че банките почват да „бягат от депозитите“, което допълнително ще стимулира инвестициите в недвижими имоти и други алтернативи.

Запасите на строителни материали се свиха чувствително, след като доставките и логистиката пострада от пандемията, което доведе до ръст от 30-40% в цените на основни строителни материали като стомана, дърво, полипропилени тръби и др.

Балон ли е?

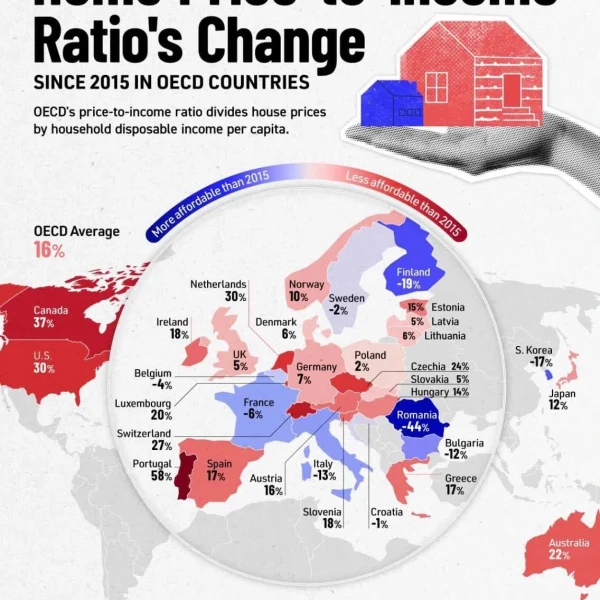

Средните цени на имотите в ОИСР растат по-бързо, отколкото доходите на хората, което прави жилищата все по-малко достъпни за средностатистическия човек. Цените се покачват по-бързо и от наемите.

Адам Слейтър, водещ икономист в Оксфорд Икономикс, касва че имотите в развитите икономики (България не е сред тях) са с около 10% надценени, сравнено с дългогодишните трендове. Това право настоящият бум в цените един от най-големите от 1900 г. насам, но по никакъв начин не може да се сравнява с лудостта в периода 2005-2008, която ни доведе до световната финансова криза.

Той отбеляза, че някои от факторите, които бутат цената нагоре са временни, като например данъчните облаги, както и проблемите в глобалната логистична мрежа на доставките.

Ръстът в ипотечните кредити е по-нисък в сравнение с периода преди кризата от 2008 г., което води до по-нисък риск от балонизиране.

Според Дениз Игън (заместник началник на марко-финансовия отдел на Международни Валутен Фонд (IMF)),ръстът в ипотечните кредити е движен от потребители със сериозна финансова стабилност, като домакинствата в страните от развитите икономики като цяло не са толкова задлъжнели, както преди кризата от 2008 г., което от своя страна води до малък риск да се повторят събитията от тогава и да се стигне до изпадане в несъстоятелност и „спешни продажби“ на имоти.

Един ключов фактор е различен от ситуацията преди близо 15 години: централните банки, които се страхуват от последиците на спукването на имотния балон през 2008 г., сега са по-бдителни.

Банката Резерв на Нова Зеландия добави цените на жилищата в своя мандат, а ЕЦБ (Европейската Централна Банка) поискаха от Статистическата агенция на ЕС, да включи цените на жилищата в калкулирането на инфлацията.

Като обобщение, според водещи икономисти, политиците по света сега са сериозно осъзнати относно рисковете свързани с жилищната политика, за разлика от 2008 г., което значително намалява шансовете за неблагоприятен изход.

[grwebform url=“https://app.getresponse.com/view_webform_v2.js?u=Bhrp5&webforms_id=21751403″ css=“on“ center=“off“ center_margin=“200″/]

Предупреждение. Фондация “Делта Анализи” е регистрирано юридическо лице с нестопанска цел за осъществяване на общественополезна дейност. Материалите, публикувани в платформата, са само с информационно-образователен и проучвателен характер с цел да подпомогнат мисията на фондацията и не бива да се възприемат като специализирана консултация по сделки с недвижими имоти. Фондация “Делта Анализи” не носи отговорност за начина, по който използвате информацията, съдържаща се в сайта. Винаги се обръщайте към квалифицирани специалисти за въпроси от финансов, правен и друг характер според вашите специфични обстоятелства и предприемете действие на базата на вашия информиран избор.