Покупка на имот по време на рецесия. Добра или лоша идея?

Планирали сте покупка на недвижим имот в София и се колебаете дали сега е най-подходящия момент?

В тази статия ще анализираме сегашното положение и ще се опитаме да ви помогнем да си изградите цялостна представа за пазара на недвижими имоти в София в момента и да прецените сами дали моментът за покупка е подходящ.

От край време по медии и социални мрежи, когато стане дума за недвижими имоти се спекулира с думата „балон“. Сега през 2020 г., когато рецесията е неизбежна, поради ясни за всички причини, много хора си задават въпроса, какво ще се случва с цените на недвижимите имоти. В интернет се появяват всякакви „експерти“, които казват, че ще има срив, други казват, че ще има покачване и т.н.

От какво обаче се определят цените на имотите?

Както всеки друг пазар, цените се определят от търсенето и предлагането. На всеки е ясно, че когато търсенето е по-голямо от предлагането, то цените ще се покачват и обратното. Т.е. тук правилният въпрос е, какво се очаква да е търсенето и какво се очаква да е предлагането през 2020 г. За да може да се дадат каквито и да е прогнози, трябва да се сглобят много различни фактори.

Търсенето в София

Лесно може да се каже, че идва криза, хора се регистрират на борсата, губят си работата и това ще доведе до голям спад в търсенето на имоти. Няма да се изненадате, ако ви кажем, че грубо 2/3 от купувачите в последните 5 години са IT специалисти. Технологичните компании не са спирали да работят, а голяма част от тях още през януари репетираха сценария с работа от вкъщи и бяха подготвени. Голяма част от купувачите са и хора от провинцията, които мигрират към София, заради образование и професионално развитие. Няма да се изненадате, ако ви кажем, че хората, които са заети в туристическия и ресторантьорския бизнес не представляват сериозен процент от купувачите на имоти в София. По-скоро собствениците и мениджъри на хотели и ресторанти са малка част от купувачите на имоти в София, които са и ще бъдат най-силно афектирани.

Така придобивате визия за картината на купувачите на имоти в София. Пропуснахме да споменем и това, че вече се забелязва и тренда на връщащи се българи от чужбина, за първи път от десетилетия насам има баланс между заминаващи и връщащи се българи за и от чужбина. Това не е прецедент, защото в Полша в последните години една от причината страната да се развива икономически е това, че голяма част от хората, които са живеели и работели за дълго в чужбина са започнали да се връщат и установяват обратно в родината, да инвестират спестяванията си и да прилагат опита си.

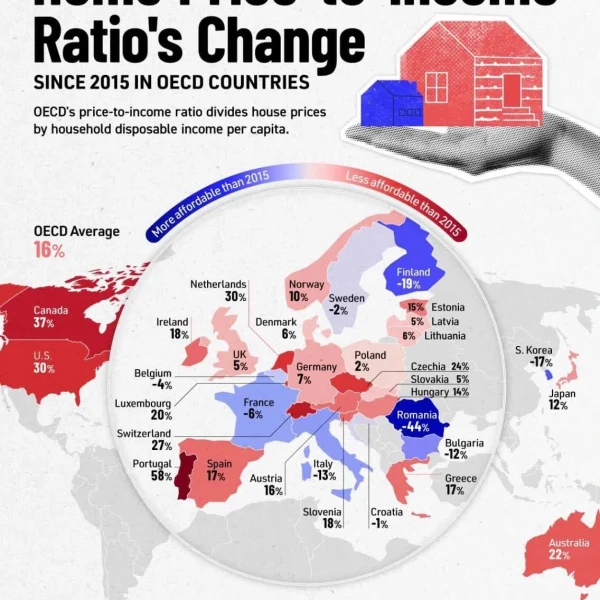

Средната цена на недвижими имоти в София е около 1000 EUR на м2. (fakti . bg). Това е най-ниската цена за недвижими имоти в столица в ЕС. Дори имотите в Скопие (Северна Македония) са на сходни, даже и по-високи цени: средно около 1100 EUR на м2. (Realigro . bg).

През последните седмици наблюдавахме как в световната икономика се вливат трилиони долари. Ако в момента инфлацията все още не се усеща, то след около година ефектът ще е неизбежен. По данни на БНБ банковите депозити на българите надвишават 83 млрд. лв., което е исторически рекорд (няколко пъти повече от 2010 г.). Много хора все още имат ясен спомен от фалита на КТБ. Също така някои помнят и хиперинфлацията през 1997-ма и как спестяванията на много българи бяха буквално унищожени. В момента този сценарии до голяма семен не е вероятен. Въпреки това, заради продължаващото т.нар. “печатане на пари” от централните банки, инфлация със сигурност ще има. Дори да не се усеща от повечето хора, то в средносрочен и дългосрочен план, тези които имат спестявания ще го усетят най-силно, защото в крайна сметка покупателната способност на техните пари намалява. Колкото и сложно да изглежда представено от медии и експерти, в крайна сметка резултатите са прости за разбиране: парите, които не се инвестират, а стоят по депозити губят стойност месец след месец и година след година.

Като комбинираме исторически високите нива на спестявания в депозити на българите, с нарастващата инфлация и задаващата се рецесия (икономическа криза) с това, че инвестицията в недвижим имоти винаги е била най-предпочитаната инвестиция за българина и начин за защитаване на трудно изкараните и спестени пари, то е възможно да се повтори, това което се получи след фалита на КТБ, а именно: ръст в търсенето и покупките на имоти, поради спад на доверието в икономиката и банките и като инструмент за защита на спестяванията.

Както виждате не е лесно да се прогнозира какво ще стане с търсенето. Факт е че в момента имотния пазар е на пауза, но след като свикнем с новия вирус и отново натиснем бутона „плей“, има достатъчно аргументи, че търсенето няма да намалее, както и има аргументи, че ще намалее.

Но да се говори за срив в цените и за други апокалиптични варианти е непрофесионално и до голяма степен всяване на страх. Защо мислим така, продължавайте да четете…

Виж по-Голямата Картина на Новото Строителство в София. Получете по email@ достъп до Актуална Информация днес.

Получете по имейл достъп информация за Новите Жилищни проекти в София. Информираност за Пазара в реално време. Включени и Перспективни Райони в София. Описание, локации, концепции и прогнози. Информация директно от инвеститори. Избирайте Информирано, а не по слухове.

Предлагането

Това, което професионалните брокери на недвижими имоти споделят е че вече е сигурно: голяма част от планираните нови жилищни проекти се отлагат и не стартират в момента. Големи проекти за стотици хиляди РЗП (разгърната застроена площ) планирани за 2020 ще се отложат.

Инвеститорите оценяват риска от задаващата се икономическа криза и затова отлагат старта на проектите, за период, в който ще има повече яснота. Така производството на нови жилищни единици е в застой.

Инвеститорите, които са в процес на строителство и са започнали преди извънредното положение до голяма степен са спокойни. Предлагането преди този период така или иначе не надвишаваше търсенето, поради което проектите в етап на строеж са наполовина разпродадени. Така тези инвеститори са спокойни, ако темпът на продажба се забави, финансово са осигурени и не мислят да намаляват цените.

Какво ще стане с имотите, купени на кредит и хората, които останат без работи и не могат да покриват вноските си? Не забравяйте, че в краен случай тези имоти могат да бъдат отдадени под наем за известен период. Не забравяйте, че на този пазар има и много продавачи, които не са придобили имота с кредит и които, както финансово обезпечените инвеститори, нямат зор да продават, че даже и да свалят цената. Те просто спират имота си от продажба, което вече се наблюдава и ще го върнат в пазара, когато цената ги устройва.

Съществуват още редица други фактори, които накланят везните в едната или другата посока и едва ли има някой, който може да предвиди или проучи всеки един от тях и да даде точна прогноза. Истината е, че все още е много рано да се каже.

Добра или лоша идея е да си закупим имот по време на рецесия и по-специално сега, през 2020-та? Отговорът се крие в един основен въпрос, който най-вероятно всички си задават.

Ако ще последва криза, не е ли по-добре да изчакам цените да паднат, както стана през 2008-ма?

Каква е разликата между тази ситуация и кризата през 2008 година?

Първо по отношение на пазара на недвижими имоти тогава и сега трябва да изчистим понятието „балон“. Графиката проследява цените на кв/м на имотите в кв. Дружба за периода от 2003 г. до момента. Графиките за всички квартали са идентични.

Между 2006-та и 2008-ма средната цена на кв.м. от 526 € скача до 933 € и това за период по-малък от 2 години, докато сегашните цени са в следствие на плавно покачване за доста по-дълъг период. Освен това за целия период от 2010-та до момента чуждестранните инвестиции в недвижими имоти са пренебрежително ниски в сравнение с милиардите външни инвестиции за периода между 2006-та и 2008-ма. Колкото и да се спекулира, че цените са високи в момента, те все още не могат да достигнат нивата от 2008-ма година, при положение, че доходите от тогава до сега са се увеличили многократно. Съвсем друга е ситуацията с пазара на труда, сега има многократно повече възможности за работа. Пазарът на недвижими имоти в София в момента не е балон и няма да се спука, за да се сринат цените. Може да има корекция в цените, може и да няма, ситуацията е нетипична и безпрецедентна. Идва криза и компании фалират, но други компании просперират. Има хора със спестявания в банкови депозити, които също се притесняват, защото централните банки „печатат“ трилиони и парите се обезценяват. Може да има спад в търсенето, но може и да има ръст. Има спад в производството на имоти, но то може и да се възобнови и големите проекти да стартират скоро.

В заключение, ако имате спестени средства и имате причини да инвестирате в имот или да купите жилище, то следете ситуацията и пазара и действайте, ако намерите подходящ имот. Бъдете активни, защото е възможно да сключите изгодна сделка, което намя как да стане, ако само четете статии от експерти по висчко. Дори за определен период цените да паднат, няма да се сринат. Да чакате една година за 10-15% по-ниска цена, не си заслужава, особено ако плащате и наем, защото не е сигурно дали ще стане, но е сигурно, че парите ви ще се обезценят с около 4%-5%. В дългосрочен план цените на имотите се покачват, а парите се обезценяват.

[grwebform url=“https://app.getresponse.com/view_webform_v2.js?u=Bhrp5&webforms_id=23387203″ css=“on“ center=“off“ center_margin=“200″/]

Предупреждение. Фондация “Делта Анализи” е регистрирано юридическо лице с нестопанска цел за осъществяване на общественополезна дейност. Материалите, публикувани в платформата, са само с информационно-образователен и проучвателен характер с цел да подпомогнат мисията на фондацията и не бива да се възприемат като специализирана консултация по сделки с недвижими имоти. Фондация “Делта Анализи” не носи отговорност за начина, по който използвате информацията, съдържаща се в сайта. Винаги се обръщайте към квалифицирани специалисти за въпроси от финансов, правен и друг характер според вашите специфични обстоятелства и предприемете действие на базата на вашия информиран избор.