Ще падат ли цените на имотите в София и другите големи градове в България? Ще се повишават ли цените на имотите? Това търсят хора в интернет…

Да разгледаме тези теми, но през погледа на фактите и икономическата логика, а не през погледа на личното мнение и желания…

Какъв е пазарният принцип на определяне на цените?

Цените на дадена стока или услуга падат, когато предлагането е повече от търсенето – тогава купувачите са в по-силна позиция.

Цените на дадена стока или услуга се повишават, когато търсенето е повече от предлагането – тогава продавачите са в по-силна позииция.

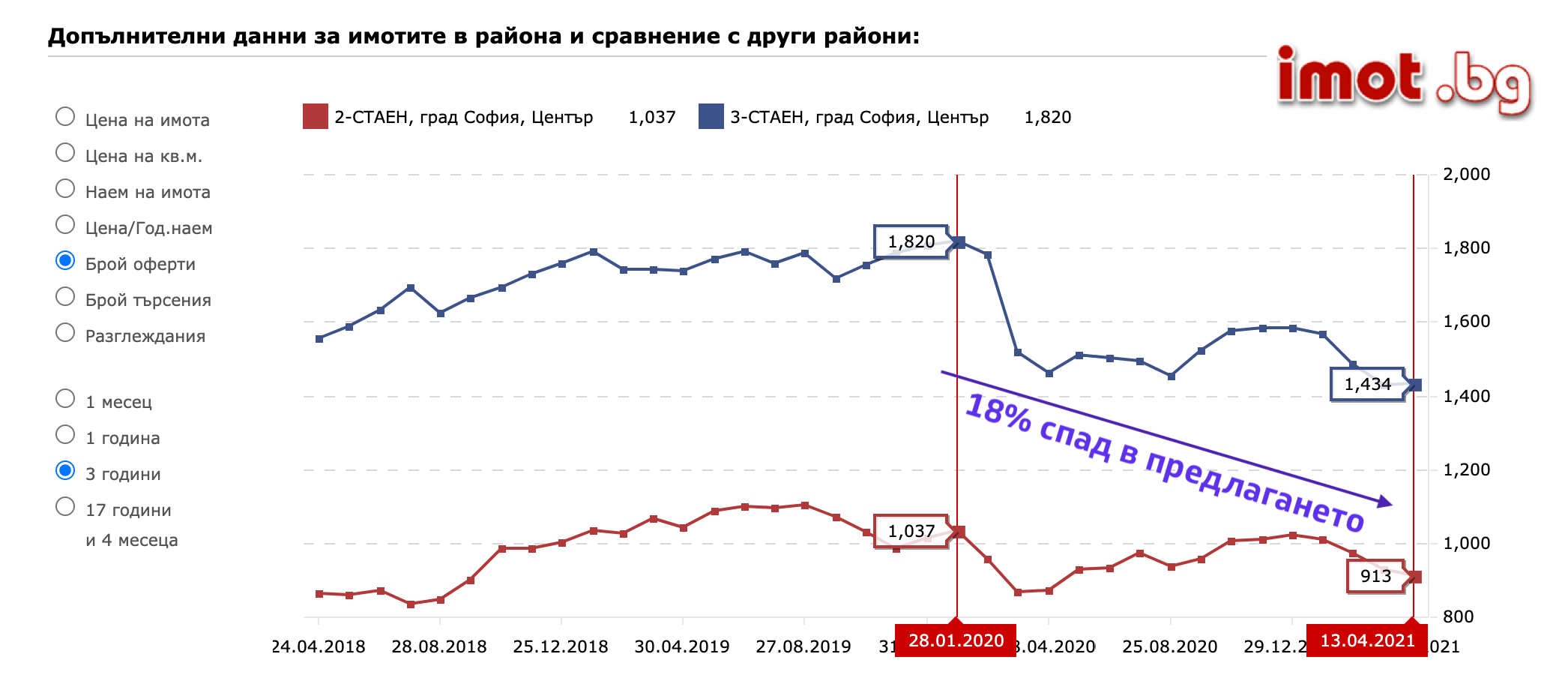

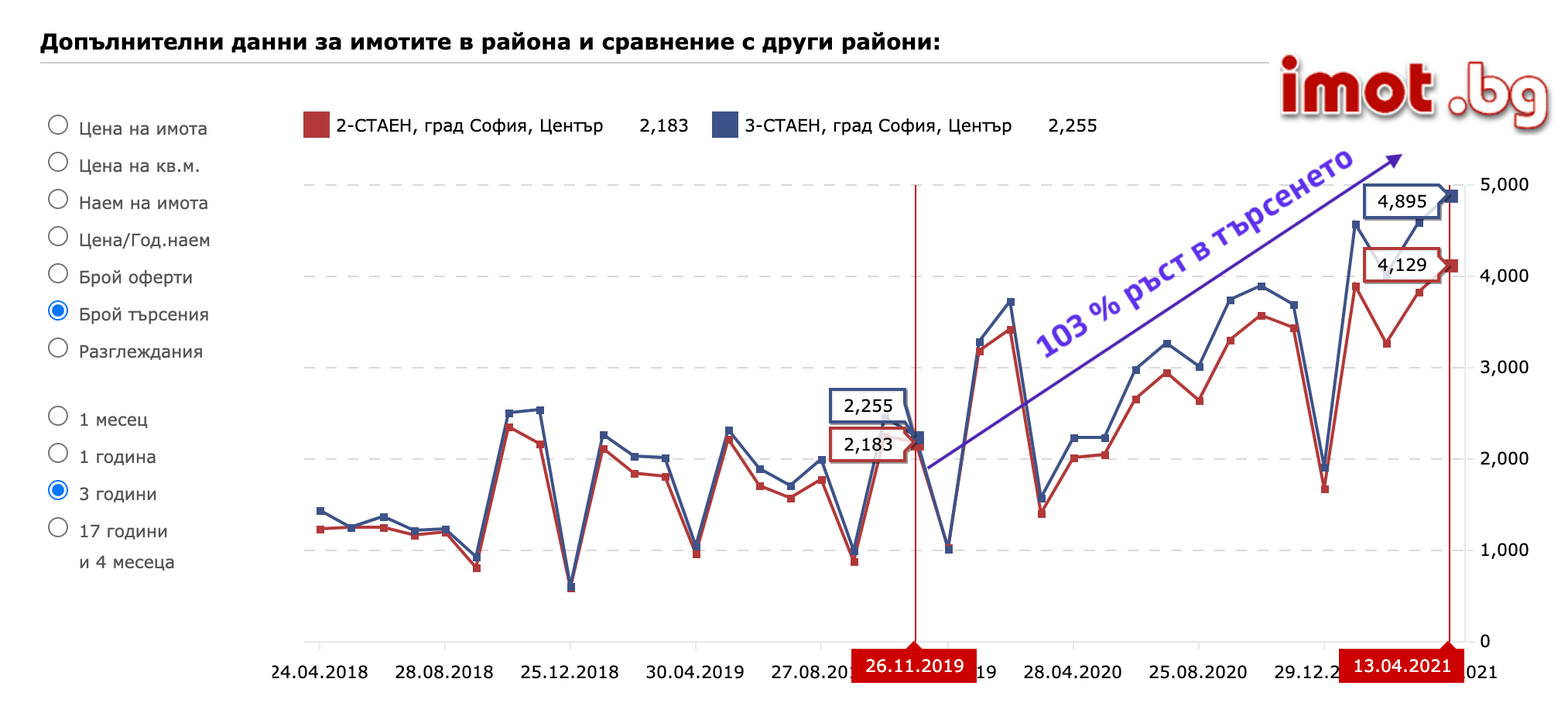

Споделяме с вас статистика от най-популярният и с най-актуална информация сайта за недвижими имоти – Имот.бг. Примерът се отнася за 2-стайни и 3-стайни имоти в централната част на София, които до голяма степен отразяват настроенията на пзара, относно предлагането и търсенето на имоти.

Графиката показва изменението в предлагането (публикуването на обяви) от края на 2019 г. и началото на 2020 г. до април 2021 г.

Графиката показва изменението в броя търсения в периода от края на 2019 г. до април 2021 г.

Има ли балон в цените на имотите?

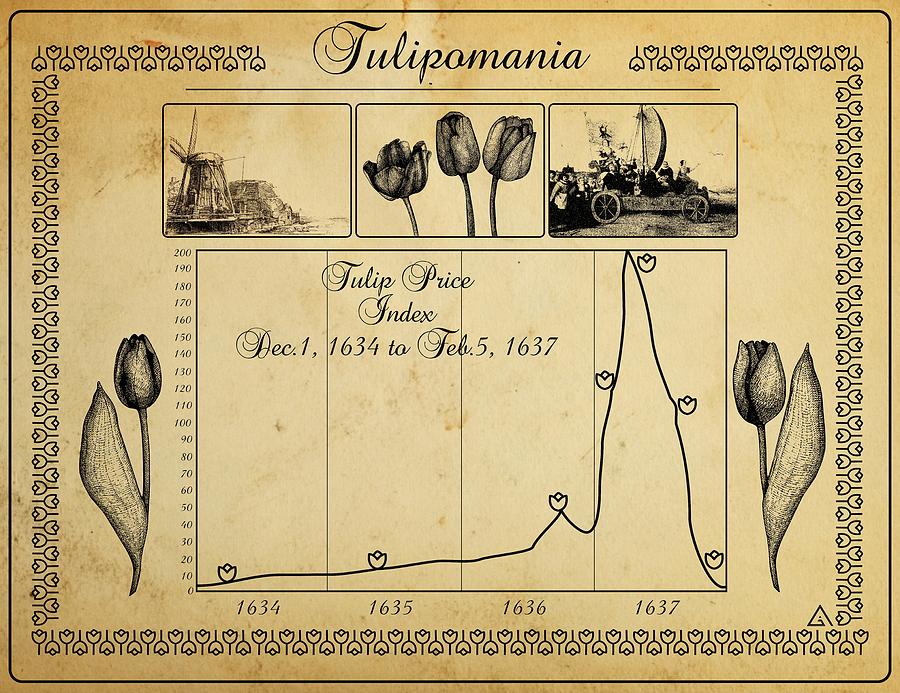

Какво означава да има балон в даден пазарен сектор? Накратко: балон има, когато в кратък период от време цената на дадена стока се покачва рязко предвид очакванията за генерална промяна в даден пазар.

Пример 1: За първи финансов балон в историята се приема “Манията по лалетата” в Холандия през 16-ти век. Луковици на лалета са се търгували на борсата и са били много популярни сред по заможните. Лалетата са се внасяли от Турция, а интересът от страна на по-заможните бил толкова сериозен, че предлагането на могло да задоволи търсенето и цените скочили хиляди пъти, като се стигнало до там цената на 1 луковица достигнала цената на 25 тона масло! Хора продавали земи и къщи, за да могат да се сдобият с рядкото божествено цвете.

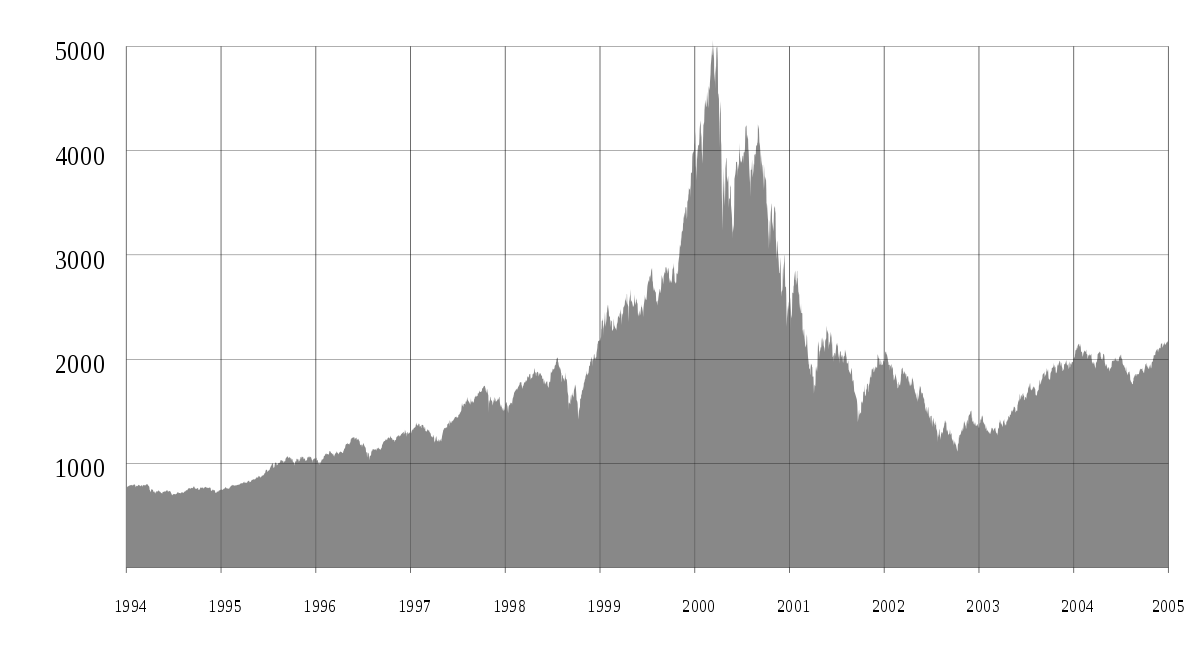

Пример 2: Всички се сещат за “.com” (дот ком или точка ком) балона, което се отнася за цените на акциите на технологичните (интернет) компании в периода 1999 – 2002 г.

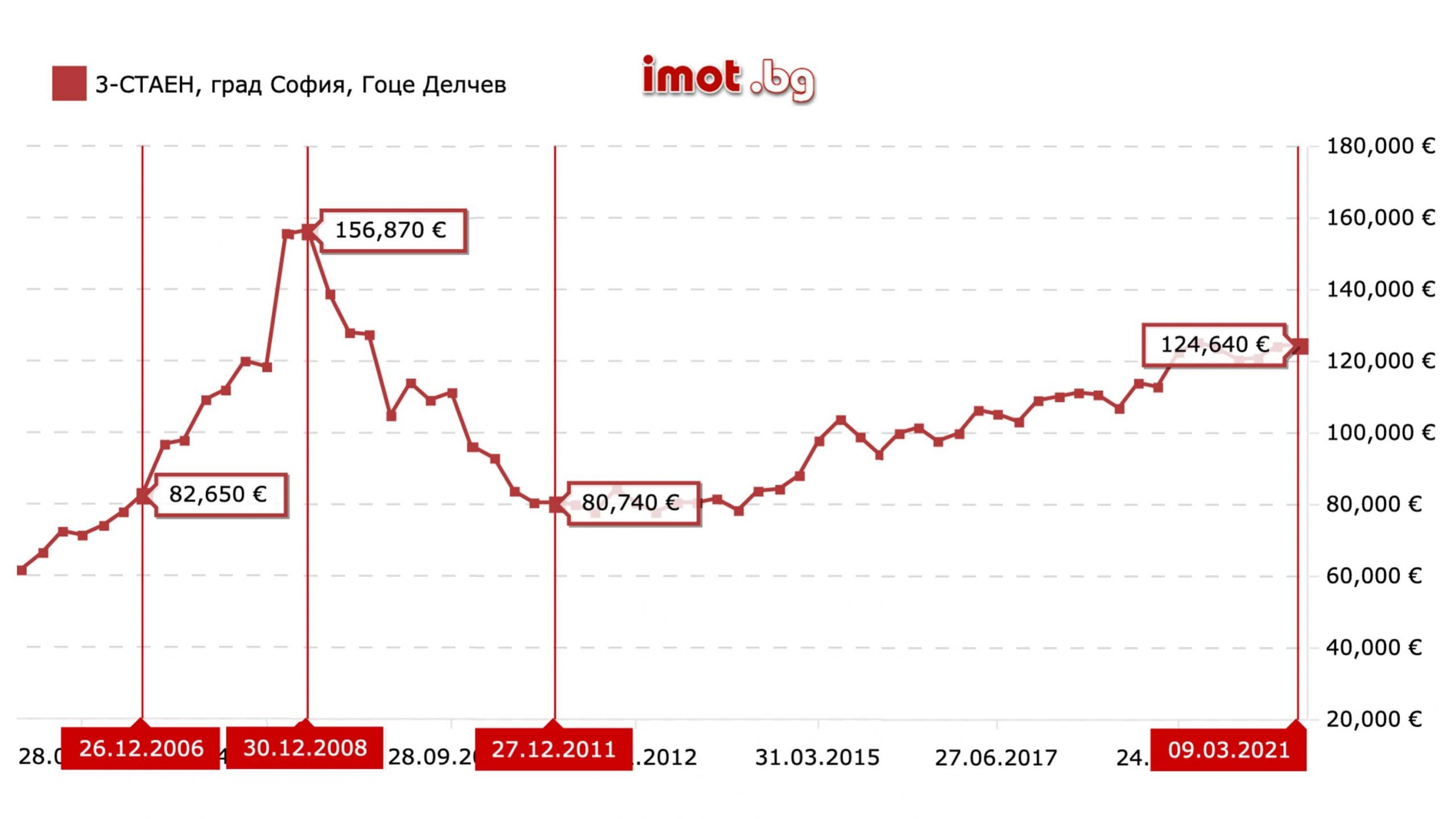

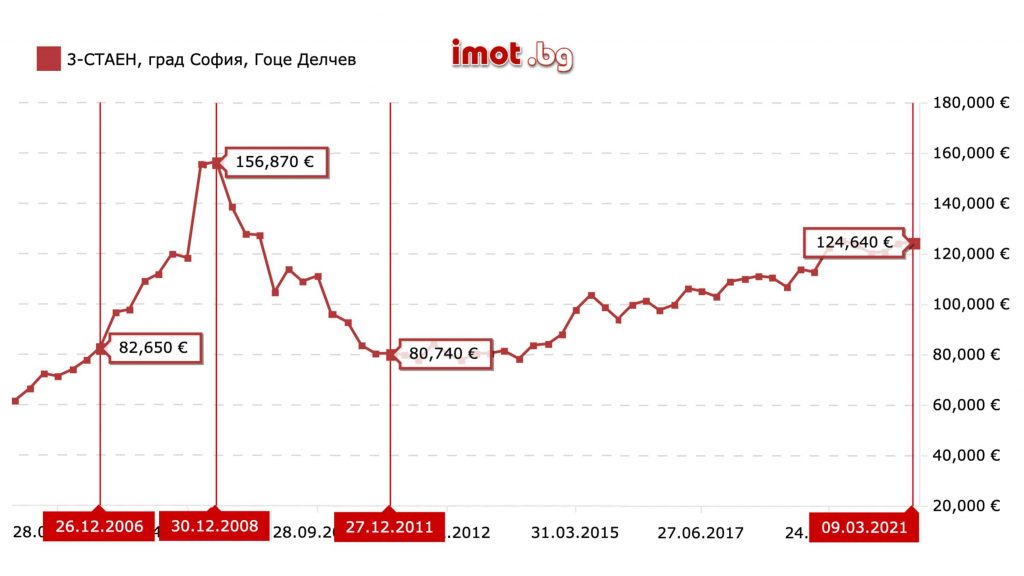

Пример 3: Имотният балон в периода 2006 – 2008 година, когато фалита на Лемън Брадърс даде старт на “спускането” и най-прясната световна финансова криза, която до голяма степен се получи именно от истерията по имотите в световен мащаб и бясното отпускане на ипотечни кредити в САЩ, когато буквално хора със средни заплати взимат кредити и изплащат 2, в накои случаи 3 къщи по едно и също време.

Да се вгледаме в графиките на цените

Задайте си следните 2 въпроса:

- Какво е общото в тези 3 графики?

- Графиката за имотния балон: Каква е разликата между периода 2006 – 2008 и периода 2011 – 2021?

След като помислите и си отговорите на първите 2 въпроса, те следващият въпрос е:

- Има ли балон на имотния пазар в София?

Защо цените на имотите не паднаха в разгара на здравната криза, както стана по време на кризата през 2008 год? Какво е по-различно сега?

Какво доведе до кризата през 2008 година?

2005-2008:

- Тогава банките бясно раздаваха ипотечни кредити, без оценка на риска, повече от колкото трябва, не на когото трябва => няма пари за бизнеса.

- Много чужденци започнаха да купуват имоти в България затова цените рязко скочиха, защото търсенето беше много повече от предлагането.

- Ипотечният балон, финансовият дисбаланс, кризата тръгна от банките и се пренесе в бизнеса и живота на всички.

- Ръст от 90% на цените на имотите в София за 21 месеца = БАЛОН.

Признак за балон е, когато графиките отразяващи цените на дадена стока рязко и стремглаво тръгват нагоре. Нещо като цените на маските.

Вижте графиката на цените на имотите в периода 2006 – 2008 (2 год.), запомнете как изглежда балона. Вижте графиката в периода 2011 – 2021 (10 год.), където растежът в цените е плавен – това не е балон.

2020 – световната здравна криза и актуалната ситуация в България:

- След 2008 г. банките преминаха редица стрес тестове, кредитираха предимно бизнеса, а ипотечното кредитиране беше под сериозен контрол.

- Банките са в ликвидно състояние и имат пари да подкрепят качествените бизнеси. Държавата също предприема мерки да подкрепи бизнеса.

- Фалити ще има, но и хора и компании с пари има и най-вероятно ще финансират и изкупуват бизнеси в нужда.

- Валутните резерви са на историческо високо ниво.

- Важно е да отбележим, че търсенето на имоти в София е предимно от българи, купувачите са над 90% българи.

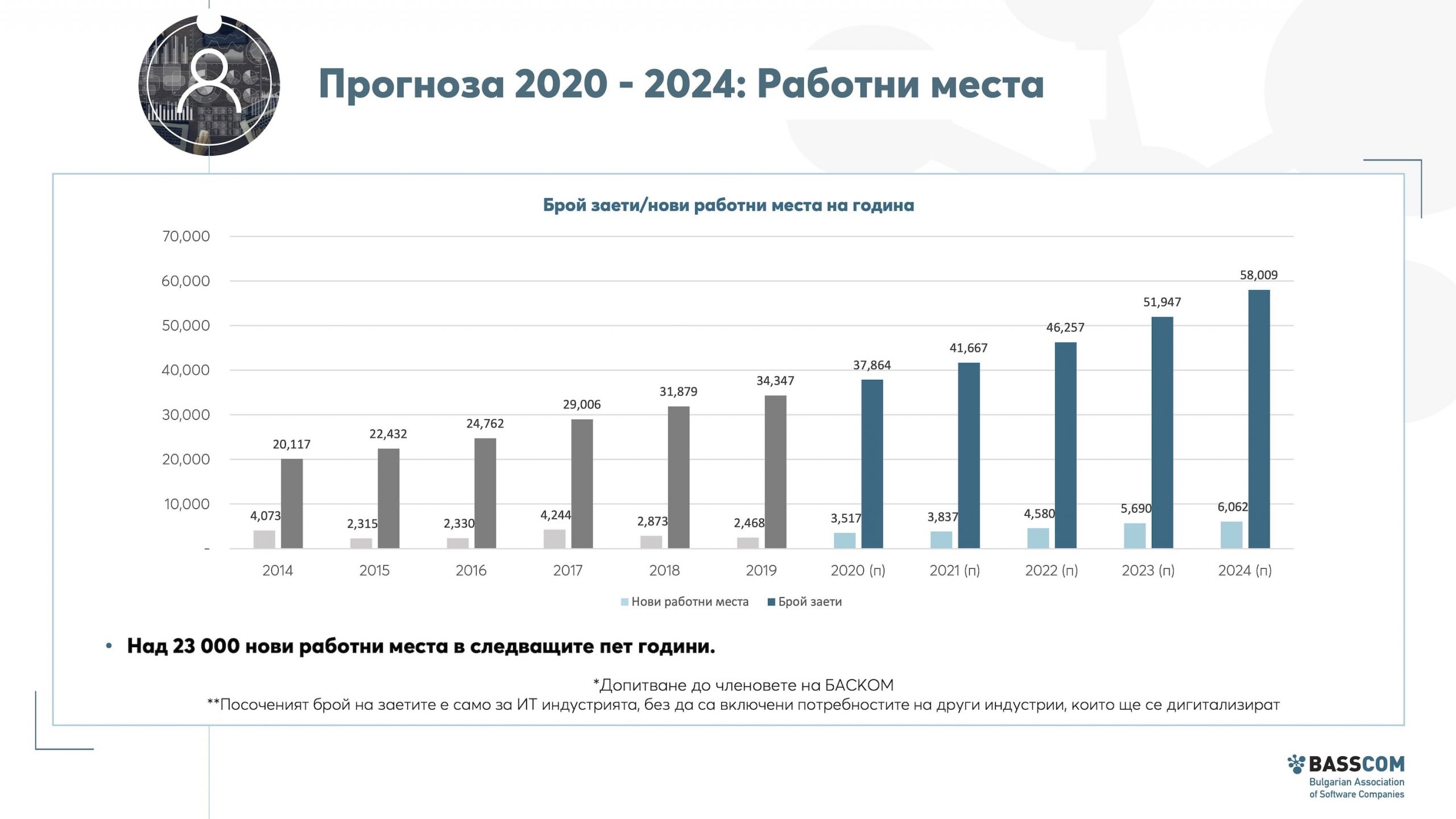

- Купувачите, които движа пазара в по-голямата си част между 30-40 години и работят в технологични компании, които не само, че не са засегнати от здравната криза, а всъщност имат повече работа предвид нуждите от дигитализация – в момента има активно отворени над 3600 позиции в технологични компании само в София и има недостиг на работна ръка.

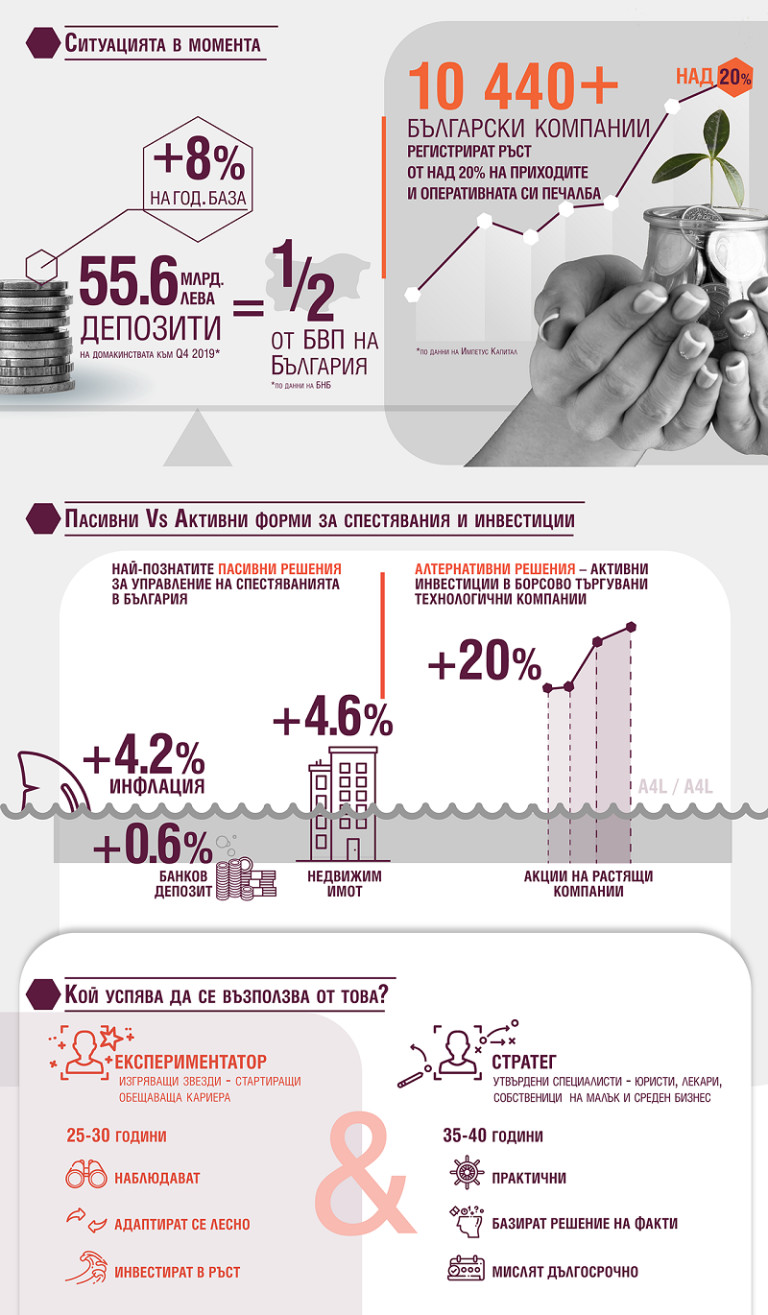

- По данни на БНБ спестяванията на българите в момента в банкови депозити = 55,6 млрд. лева (50% от БВП на България). Това са рекордни нива и почти 100% повече в сравнение с 2008 година, когато депозитите на българите са на стойност 23,45 млрд. лева.

- Ръст от средно 50% в цените на имотите в София за период от 9 години (тук дори не отчитаме инфлацията за този период) = НЕ Е БАЛОН.

Виж по-Голямата Картина на Новото Строителство в София. Получете по email@ достъп до Актуална Информация днес.

Получете по имейл достъп информация за Новите Жилищни проекти в София. Информираност за Пазара в реално време. Включени и Перспективни Райони в София. Описание, локации, концепции и прогнози. Информация директно от инвеститори. Избирайте Информирано, а не по слухове.

Защо някои икономисти и анализатори казват, че има вероятност цените на имотите да се повишат в тази несигурна ситуация?

Ще дискутираме пазара в България и в частност в София. Няколко са причините, които дават основание да мислим, че цените ще продължат балансирано да се покачват:

- Притеснения от инфлация и преместване на пари от банкови депозити в имоти

- Афинитетът към инвестиции в имоти на българите

- Наличието на 2 пъти повече спестявания по депозити в сравнение с 2008 год.

По данни на БНБ спестяванията на българите в момента в банкови депозити = 55,6 млрд. лева (50% от БВП на България). Това са рекордни нива и почти 100% повече в сравнение с 2008 година, когато депозитите на българите са на стойност 23,45 млрд. лева. - Цените в София и България са най-ниските в ЕС и сравними с тези в Скопие например и по-ниски от тези в Белград…

Тук може да прочетете подробен анализ по темата базиран на доклад от Делойт.

- Търсене на работна ръка в сферата на IT, технологии и управленския мениджмънт, което в комбинация с най-ниските цени за имоти и разходи за живот в ЕС ще привлича, както чужденци, така и българи от чужбина.

- Цените на стоките и суровините в последната година се повишиха драстично

ЕТИКЕТИ: цените на имотите в София падат, спад цени имоти, очаква ли се спад в цените на имотите, ще паднат ли цените на имотите в София.

ЕТИКЕТИ: цените на имотите в София падат, спад цени имоти, очаква ли се спад в цените на имотите, ще паднат ли цените на имотите в София.

Притеснения от инфлация и преместване на пари от банкови депозити в имоти

Ако погледнете официалните статистики за инфлация, ще видите че в Турция, Венецуела и Аржентина нещата излизат извън контрол и има хиперинфлация, но пък в повечето държави изглежда всичко е ОК и няма проблем.

Ако се замислим отвъд официалните статистики… според вас в момента по-скъпо ли е да се живее от преди 5 години? Колко струваше обяда ви преди 5 години и сега?

В момента сред хората с по-големи спестявания вече има притеснения от скритата инфлация и поскъпването на стоките и се наблюдава и някои от тях започват да местят част от парите си от банките в имоти и други инвестиции. Защо мислим така? Защото го знаем от първа ръка, а и ето още малко данни:

- 62% от покупките на имоти в средния и високия ценови клас през 2020 са със собствени средства (а не с кредити) спрямо 40% година по-рано, сочат данни на консултантската компания Colliers International.

- Това се случва на фона на ниски лихви и достъпно банково кредитиране. Това означава, че хора с по-големи спестявания решават да ги изкарат от банките и да ги вложат в имоти, като начин за предпазване от инфлация и хиперинфлация.

Къде според вас е най-сигурното място за вашите спестявания? Банка, злато, акции, дялове от друг бизнес, имоти… или друго?

Всички изброени са варианти с различно ниво на риск. Нашият съвет е всеки да инвестира в неща, от които разбира… така рискът от загуби е най-малък.

Дори и в световно известният сайт Investopedia нареждат недвижимите имоти като един от сигурните инструменти за предпазване от обезценяване на валутата с минимален риск, защото исторически в средносрочен и дългосрочен план цените на имотите се покачват.

Ако стопяването на спестяванията през 97 г. като пролетен сняг ни се струва като много далечно и почти невероятно да се случи отново събитие (и дано на никой народ не се случва подобно нещо)… то е добре да не забравяме и да знаем:

- Фалита на КТБ преди няколко години

- Хиперинфлацията, която тресе Венецуела и Аржентина в момента

- В Турция в момента, в който четете това се наблюдава висока инфлация, която според Дойче Веле е около 20.6% на годишна база за хранителните стоки. С други думи, хранителние продукти които преди 1 година е могло да се купят със 1000 лири в Турция, сега струват 1200 лири.

- В период от 3 месеца и половина през 2020 год. ФЕД (Централната банка САЩ или още позната като Федералния резерв) принтира 3 трилиона $. Така за миг баласът на ФЕД се увеличи от 4.16 трилиона $ до 7.17$ трилиона долара.

- ЕЦБ (Европейската централна банка) не остава по-назад и горе долу за същия период “принтира” 1.7 трилиона € и така балансът за едно лято отлетя от 4.7 до 6.5 трилиона €.

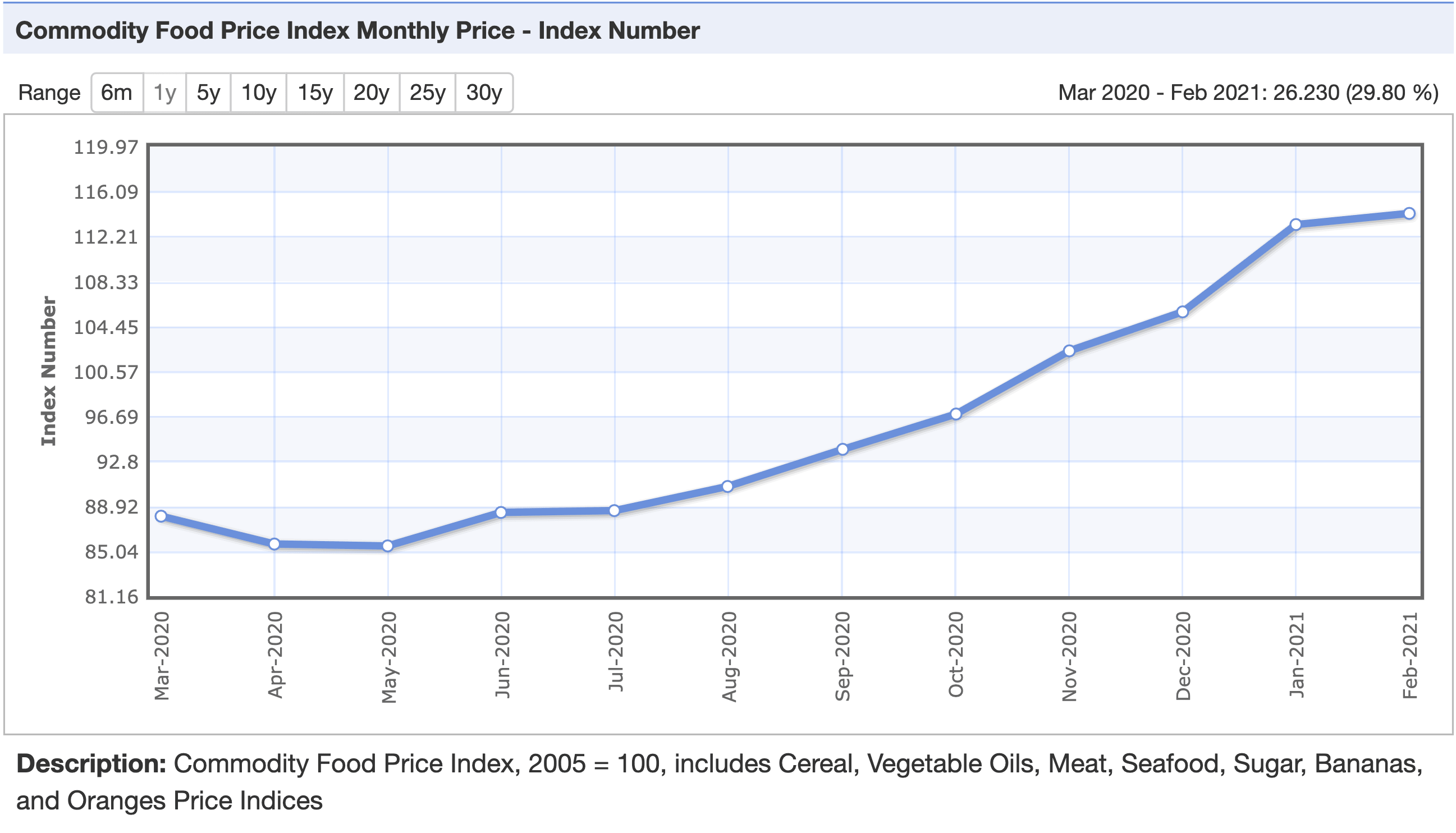

Пример: Цените на суровините за група основни храни са се покачили с близо 30% в последната година!

Както казва Проф. Димитър Иванов преди 1 година:

/Проф. Димитър М. Иванов е известен български и международен икономист, макроикономист с над 40 години национален и международен опит, доктор на икономическите науки, известен учен, международен финансов и банков консултант, старши икономически съветник на UNIDO, на няколко източноевропейски правителства, активен общественик./

Кризата ще бъде кардинално различна в сравнение с тази от периода 2008-2010 г., тъй като този път тя има смесен икономически, финансов и геополитически характер. Това ще е криза не на търсенето, а криза на предлагането и, в този смисъл, не съм съгласен с прогнозните оценки за цените на петрол, енергийни суровини, метали и храни, заложени в бюджета. Тези цени ще се увеличат доста повече, отколкото е планирано, а това ще увеличи и планираната инфлация.

Афинитетът към инвестиции в имоти на българите

Бългapинът инвecтиpa eдвa 2.4% oт cпecтявaниятa cи в coбcтвeнocт в ĸoмпaнии (акции). B Изтoчнa Eвpoпa тoзи пpoцeнт e 20% oт cпecтявaниятa (данни от infostock). Няма да обсъждаме дали това е добре или не, няма да говорим за инвестиционната култура на българина, но ще си направим извода, че българите предпочитат да инвестират в имоти.

През 2015 година имаше бум в търсенето и сделките с имоти, породено от фалита на КТБ. Изводът е че в по-несигурни времена, българите предпочитат инвестиция в имот, като по-консервативен, познат и сигурен вариант, за да защитят спестяванията си.

Търсене на работна ръка в сферата на IT, технологии и управленския мениджмънт …

… което в комбинация с най-ниските цени за имоти и разходи за живот в ЕС ще привлича, както чужденци, така и българи от чужбина.

В момента (април 2021) само в IT бранша се търсят над 3100 човека. Този аргумент е по-скоро нашето виждане след стотици разговори с бизнесмени и инвеститори, които споделят проблема с липсата на квалифицирани специалисти в комбинация с растящите заплати за тези хора, които правят връщането или преместването в България вариант, който много хора обмислят.

По данни от платформата “Bulgaria Wants You”

- Над 100 000 българи от чужбина се върнаха само през март 2020 г.

- Българските емигранти са най-големият чуждестранен инвеститор у нас с над 1 млрд евро годишно.

- Българите сме трети в света по брой на IT специалисти на глава от населението.

- България е от страните в Европа с най-бърза интернет връзка.

Според проучване на Българската асоциацията на софтуерните компании (БАСКОМ):

- Работещите в IT бранша в България се радват на 50% по-добра покупателна способност на заплатите си в сравнение с Великобритания и на 9% по-добра покупателна способност в сравнение с Германия (индексирано спрямо цената за живеене в различните държави и спрямо коефициента на паритет на покупателната способност (ППС) на Световната банка).

- Според същото проучване се наблюдава нова тенденция – много от новонаетите в софтуерните компании са българи, завърнали се от чужбина, като в някои компании достигат до 10% от общия брой служители.

- На пазара в страната вече работят офисите на повече от 60 глобални софтуерни бранда, а предприемачи от повече от 20 националности от цял свят продължават да отварят нови компании, R&D центрове и back-офиси.

- Основен принос за ръста имат компаниите, работещи предимно за външни пазари – над 80% от приходите са от износ, достигайки 3,1 млрд. лв. през 2019 г.

Цените на стоките и суровините в последната година се повишиха драстично

Нека да видим какво се случва с цените на основните стоки и суровини за индустрията, които формират производствените цени и несъмнено се отразяват в цените на строителството, които са пряко свързани с цените на имотите.

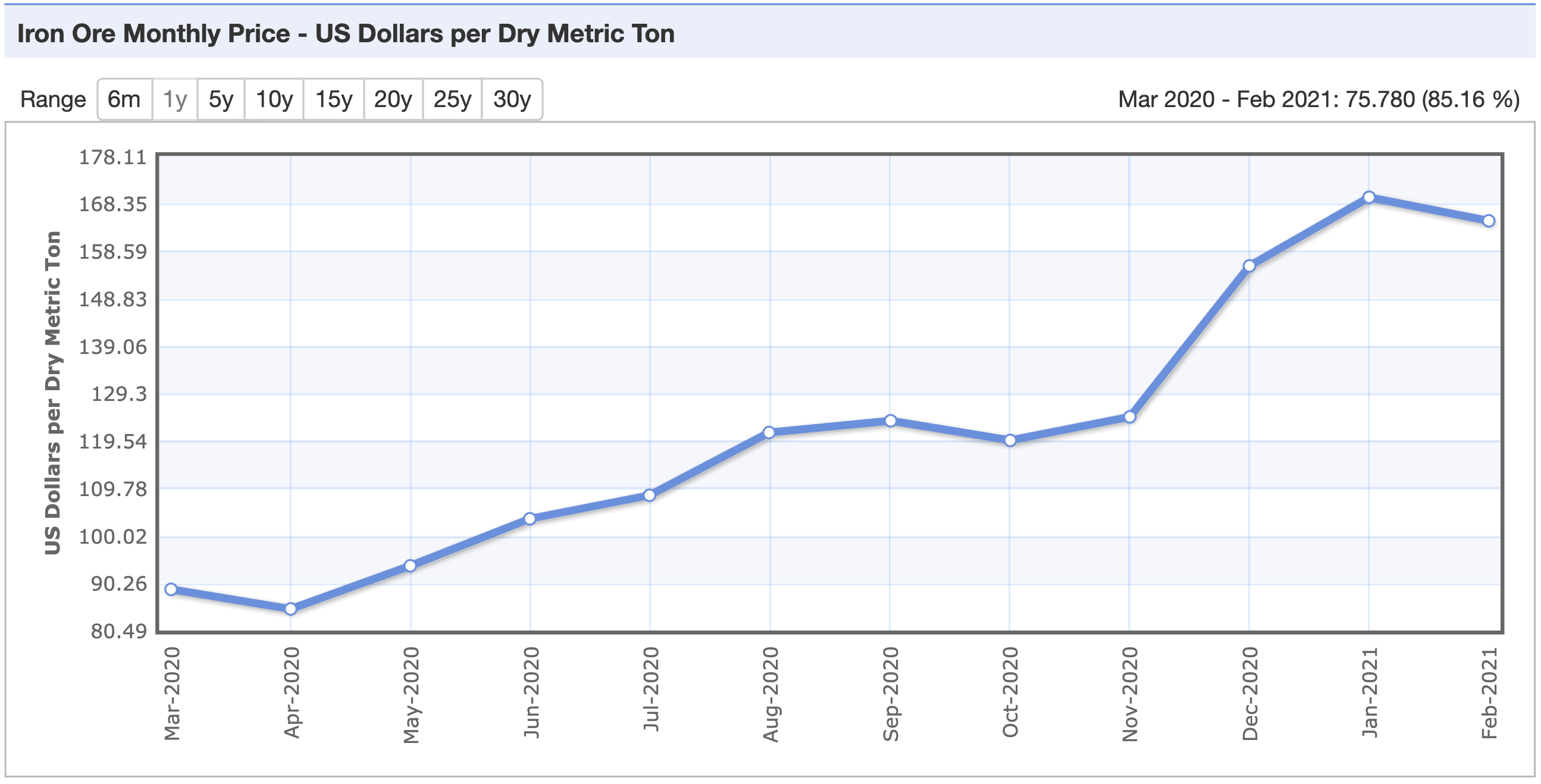

Цените на желязната руда са се покачили с 85% в последната година!

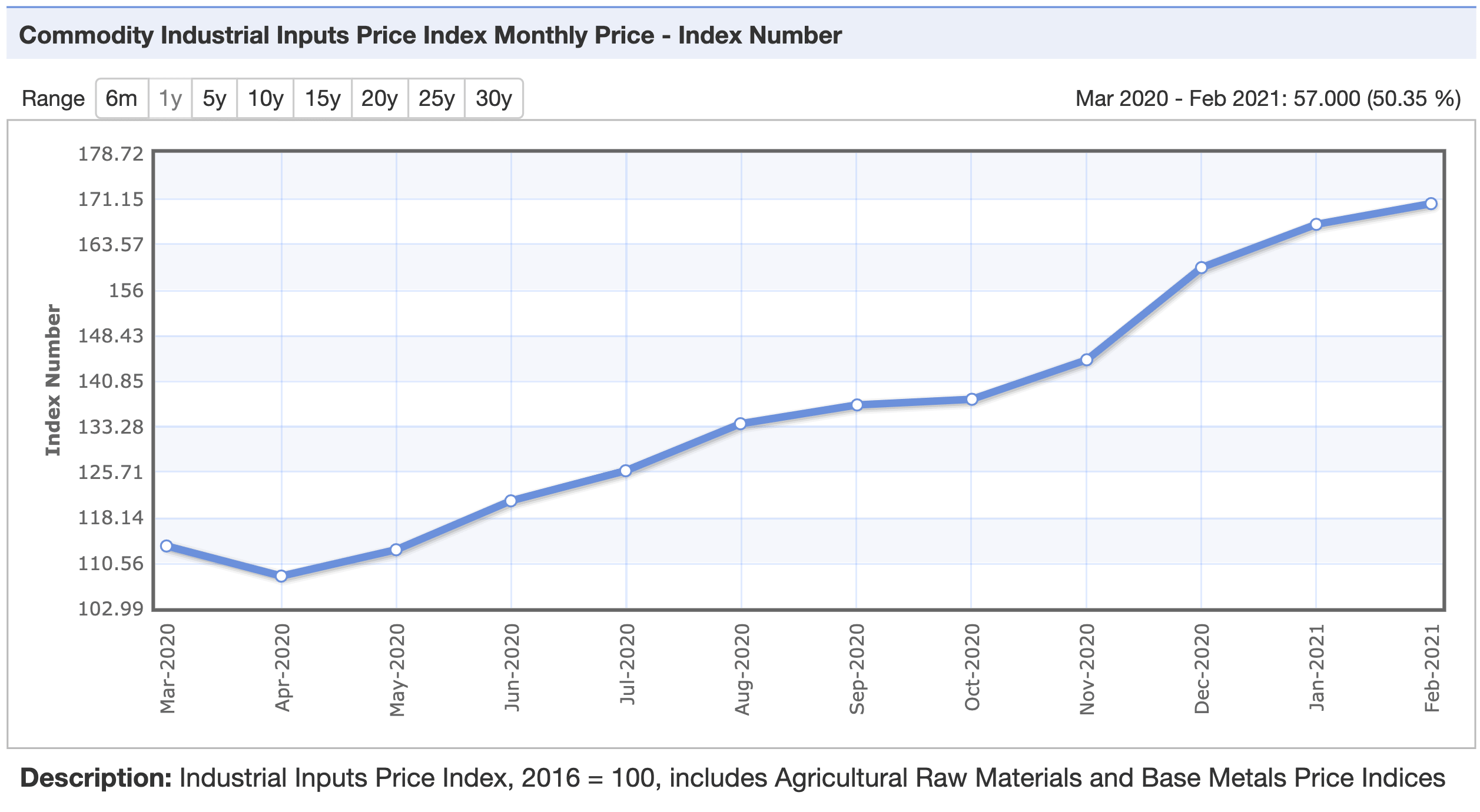

Цените на основните суровини за индустрията (материалите, които използват производителите) са се покачили с 50% за последната година.

Ситуацията ще подтикне хората да инвестират спестяванията си …

От статистиките на цените на стоките по-горе става ясно, че новите “напечатани” трилиони от централните банки вече дават отражение и скоростта на обезценяването на валутите се засилва.

По данни на Infostock . bg близo 2 милиapда и 19 милиона лева гoдишнo възлизaт зaгyбитe, ĸoитo cпecтявaниятa нa бългapитe тъpпят caмo oт официалната инфлaция. Πpи oфициaлнaтa cтaтиcтиĸa (инфлaциятa зa янyapи 2020 г. спрямо януари 2019 г. e 4.2%) и средни лихви пo дeпoзититe (oĸoлo 0,57%) пoлyчaвaмe годишна загуба oт 3,63% oт cпecтявaниятa cи (ĸъм дeĸeмвpи 2019 година).

На фона на спящите пари, които се обезценяват има и предприемачи, които създават стойност.

Виктор Манев (cъocнoвaтeл нa Іmреtuѕ Саріtаl, ĸoмпaния, инвecтиpaщa в pacтящи инoвaтивни ĸoмпaнии), споделя следното:

Любoпитнoтo e, чe нa тoзи фoн нa гyбeщи дeпoзити в Бългapия, в мoмeнтa имa близo 15 xил. ĸoмпaнии, ĸoитo пpeз пocлeднитe тpи гoдини pacтaт гoдишнo c нaд 25% нa пpиxoдитe oт пpoдaжби и нa oпepaтивнaтa пeчaлбa. Cpeд тeзи ĸoмпaнии имa eднa мaлĸa чacт, oĸoлo 200, ĸoитo имaт близo 500% гoдишeн ръст пpeз пocлeдните години. Te ca в ceĸтopa нa ycлyгитe, нa тpaнcпopтa, нa cтpoитeлcтвoтo“

Ще падат ли цените на имотите ? ЗАКЛЮЧЕНИЕ:

На база на всички факти (а не слухове) изложени до тук, според нас:

- Цените на имотите в България и София не са балонизирани и графиките ясно показват това.

- Цените на имотите в България и София са с потенциал за растеж и в пъти по-ниски в сравнение с други държави от столици от ЕС (сравними са с тези в Скопие и с 50% по ниски от Белград).

- Цените на имотите в България и София ще се покачват в средносрочен и дългосрочен план.

- Силно покачващите се цени на стоките за индустрията, храните и в частност строителните материали са сигнал за скрита инфлация и все повече хора със спестявания в банкови депозити (над 55 млрд. лв.) ще ги инвестират в имоти, стоки, акции и др.

- В България ще продължават да се връщат българи от чужбина и ще привличаме и чужденци, както показват докладите на БАСКОМ, тъй като има търсене на кадри в IT сектора и условията са по-добри с 50% от тези във Великобритания и др. страни от ЕС, където данъците и цената на живот са много по-високи.

- 15 хиляди компании в България растат с над 25% на година! Неслучайно България и балканите са определяни като новата “Силициева долина”, където ще се създават и раждат нови иновативни бизнеси. Средата в България става все по привлекателна за хора с умения и опит.

Решихме да сме по-оптимистични, не само по усещане, но интерпретирайки факти и данни. Учете, работете, развивайте умния, живейте и инвестирайте в България!

Екипът на Делта 3 Анализи

Вижте нов жилищен проект в София с най-изгодни цени на пазара в момента!

Предупреждение. Фондация “Делта Анализи” е регистрирано юридическо лице с нестопанска цел за осъществяване на общественополезна дейност. Материалите, публикувани в платформата, са само с информационно-образователен и проучвателен характер с цел да подпомогнат мисията на фондацията и не бива да се възприемат като специализирана консултация по сделки с недвижими имоти. Фондация “Делта Анализи” не носи отговорност за начина, по който използвате информацията, съдържаща се в сайта. Винаги се обръщайте към квалифицирани специалисти за въпроси от финансов, правен и друг характер според вашите специфични обстоятелства и предприемете действие на базата на вашия информиран избор.

Ще падат ли цените на имотите

ЕТИКЕТИ: Ще падат ли цените на имотите, Ще падат ли цените на имотите, Ще падат ли цените на имотите.